By M. Ali Kemal

Generational effect of fiscal deficit and debt are not hidden. Growth is an answer to most of the debt and fiscal deficit issues. Higher growth in the presence of increasing debt do not create payback problems for future generations. Whereas, fiscal deficit comes with higher future interest payments hurts the growth significantly (Kemal, Siddique, & Qasim, 2017). In addition, high fiscal deficits also worsen macro indicators such as savings, interest rate, investment, and current account deficit (Bilquees, 2003).

With the same token, as explained by Qasim and Khalid (2012) fiscal responsibility is crucial for a nation to remain prosperous and stronger in future. It also determines the prosperity of our future generations. If the fiscal responsibility is not practiced the government would spend more money than its income and the rest it borrows.

Fiscal Responsibility and Debt Limitation

Fiscal Responsibility and Debt Limitation (FRDL) Act (2005) is binding fiscal responsibility for the government to limit government’s access to borrowing for financing its expenditure. It explicitly ensure “that within a period of ten financial year, beginning from the first July, 2003 and ending on thirtieth June, 2013, the total public debt at the end of the tenth financial year does not exceed sixty percent of the estimated gross domestic product for that year and thereafter maintaining the total public debt below sixty percent of gross domestic product for any given year” [Debt Policy Statement (2006-07)].

Debt and Growth

Debt, undoubtedly is a double-bladed sword; use it wisely to increase welfare or vice versa. Kemal (2001) elucidates adverse effects of domestic and external debt accumulation and debt servicing on the poor. Yousuf and Mukhtar (2020) concludes that better and productive use of external debt in public sector development projects to foster the capital accumulation process in Pakistan. Similarly, Sheikh, Faridi and Tariq (2010) finds positive impact of overall debt and GDP growth, while debt servicing has negative impact on growth.

Government tends to do deficit financing in the lower growth episodes especially when the interest rate is higher. Therefore, financing is among the important problems. Financing at higher interest rate adds to higher cost of paying back. The IMF debt law of motion move around the interest rate-growth differential, that is, if interest rate is higher than the growth then then the debt to GDP will increase.

Necessary Conditions

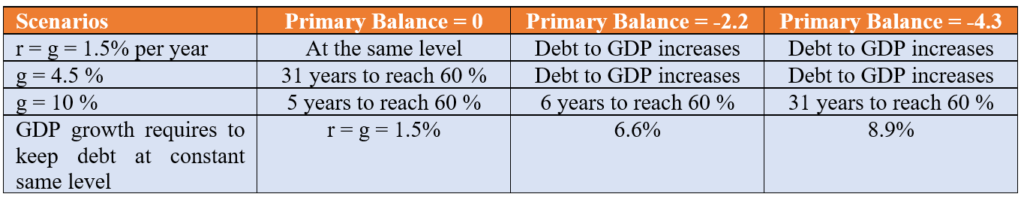

Recent PIDE knowledge Brief # 10 analyses the growth and debt nexus using the IMF debt law of motion. The have used different scenarios based on primary balance, i.e., zero, -2.2 and -4.3. Besides zero primary balance, for the other two levels it concludes that when growth is equal to the interest rate then debt as percentage of GDP remains the same. While, it is necessary but not sufficient that higher growth rate of GDP than interest rate is required to keep the speed of debt to GDP lower than otherwise.

For sufficient condition significant higher growth rate of GDP is required to maintain the debt to GDP ratio at the same level. It takes current level of debt to GDP ratio, i.e., 86 percent. It examines three components, at what growth rate with three primary balance scenario debt to GDP ratio remains same. How many years would it take to reach 60 percent of GDP with all three scenario? Table below explains the scenario given in the brief:

Source: PIDE knowledge Brief # 10

Sustainability Conditions

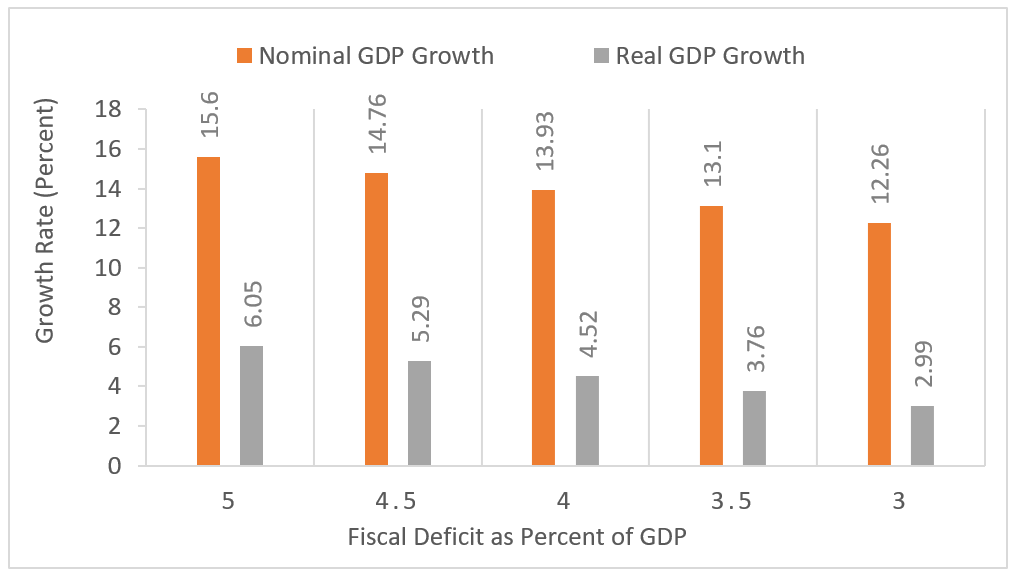

Another study Malik and Kemal (2018) explains the similar scenario while taking different levels of overall budget deficit, i.e., 5%, 4.5%, 4%, 3.5% and 3%. Study calculates sufficient condition for maintaining debt at 60 percent of GDP. They take year 2015 as benchmark period while overall budget deficit contributes to the increase in interest payments. They get two major results from the study; what should be the sustainable growth rate of GDP required to maintain debt at 60 percent and what is the level of debt in nominal terms even if we maintain debt at 60 percent of GDP.

Malik and Kemal (2018) take 2014 as benchmark period when actual level of debt was PKR 15.996 trillion, i.e., 63% of GDP. Figure 1 shows that 5 percent fiscal deficit each year demands 15.6 percent nominal GDP growth (6.1 percent real GDP growth at 9 percent level of inflation). Whereas the required growth of nominal GDP declines to 12.26 percent (3 percent real GDP growth at 9 percent level of inflation) when fiscal deficit is at 3 percent of GDP.

Source: Malik and Kemal (2018)

Debt and Productive Activities

Secondly, it is important to note that in 2014 our interest payments on the domestic debt was 4.3 percent of GDP. Whereas in 2018-19 it was 4.8 percent of GDP. Essentially, at 5 percent level of fiscal deficit was not followed. Nevertheless the calculations at 5 percent fiscal deficit tell us that to keep debt to GDP ratio at 60 percent if we can have 15.6 percent nominal GDP growth, our debt in nominal terms go up by 4.9 times by 2025 in ten years. The key is to maintain higher growth rate of GDP to sustain the debt at 60 percent of GDP. There is nothing wrong in taking debt if it is utilised in productive activities where payback is maximum.

What is Essential?

- Growth is the key to most of our problems, whether it is related to controlling unemployment, tackling inflation, increasing revenues, decreasing poverty and inequality or repayments and maintaining debt at some sustainable level.

- Higher growth rate is required to maintain debt to GDP ratio at constant level, say 60 percent of GDP.

- Higher growth rate than required would reduce the debt to GDP ratio.

- To achieve higher growth, we need to deregulate the market for the possible economic activities that are not feasible due to stifling regulations.

- Decrease “government permissions” to give relief to business activities. Permissions increase the transaction costs and create hurdles in performing normal businesses.

- Attract investment into higher returns market by removing anomalies.

- Lower reliance on government activities by either privatising the PSEs and SOEs and/or give space to private sector by reducing the government’s footprint.