By Ahmad Fraz[1]

Our Future and the Real Estate Sector

General perception among people to make their future secure drives them to invest in the real estate sector in Pakistan. However, due to heavy taxes imposed on the real estate sector by the previous government, investment trends in real estate have shrunk, resulting in a complete obliteration of this sector. Pakistan’s real estate market has a large contribution in economic growth, posting growth even as foreign direct investment falls or infrastructure spending remains stingy. The real estate sector assets contribute from 60 – 70% of the country’s wealth – approximately, USD 300 to USD 400 billion as estimated by the World Bank.

It is the second largest employment-generation sector in Pakistan after agriculture. Apart from direct employment, it also stimulates the demand of more than 400 industries of the economy from construction (cement, steel, paint, building material, architects, urban planners) to financial services (house financing). As the government has increased amounts of various taxes, especially in terms of sale and purchase, and strict measure were introduced to prove the money-trail behind the investments within last three years. consequently, this sector has suffered by a severe economic crisis, many offices of real estate consultants are closed, and millions of people affiliated to this sector are now starving.

Over-Regulation of the Market

FBR’s strict regulations (ban on non-filers, compulsory registrations when buying property of more than PKR 5 million and levying high taxes on property transfer) has discouraged investors in this sector. Although, financial markets are experiencing volatility, it’s not the economic indicator you might think. But as an investment option, a myth prevails that real estate sector makes a lot of money is not true. In most countries where financial markets are not playing a key role in economic growth, the real estate sector steps in.

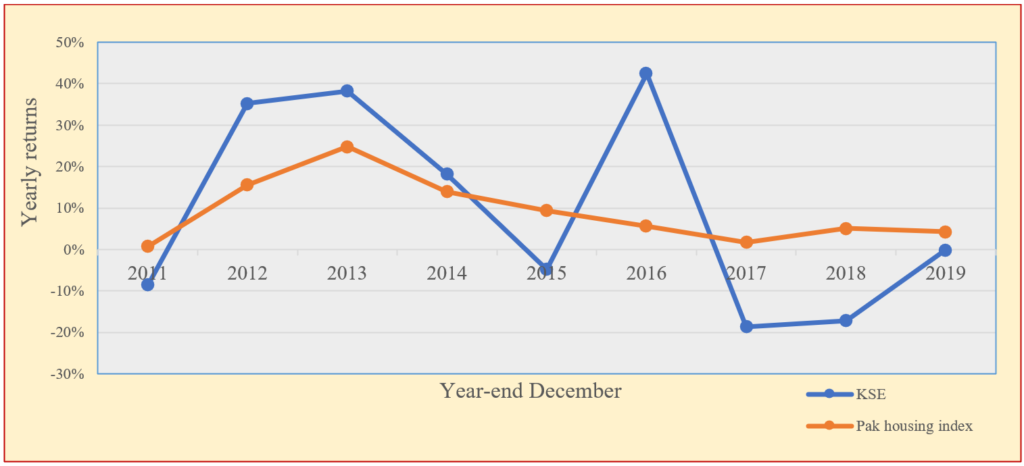

Unfortunately, this sector is not able to do so because of over-regulation by the government and the FBR. Consider the housing price index and KSE-100 index (Figure 1 below). Between 2011 and 2019, cumulative return of housing prices has been high compared to KSE-100 for only 3 years. In the same period, the KSE-100 index has increased by 230 percent versus 147 percent for housing prices.

Source: https://www.psx.com.pk, https://www.zameen.com

There are occasionally certain cycles in investments, and it has also occurred in real estate sector of Pakistan from 2012 to 2015, where yearly returns were 16 percent, 25 percent and 14 percent respectively. In all other years, return for housing index are in single digit from 1 percent to 9 percent. Whereas, the KSE-100 index is more volatile and offers high returns and high losses; the highest return earned by KSE-100 was 42 percent in 2016 and reported 19 percent loss in 2017.

The Post 2018 Real Estate Market

Real estate market has had a very difficult time after the change of regime in 2018. It has faced financial, economic, political challenges, a number of policy issues and lack of confidence. It barely managed to survive the earlier recession, mainly due to massive investments by overseas Pakistanis. Depreciation of the Pakistani rupee made property investment cheaper due to exchange rate benefits for overseas investors.

According to Zameen.com, over 30% of traffic on their site is from overseas Pakistanis looking for investment. But investing in the real estate market is already risky, as Pakistan currently ranks 120th out of 129 countries (scoring just 3.9/10). This type of ranking is an important consideration for overseas investors. In the presence of such uncertainty and tax policies, thousands of the overseas investors have diverted their investments elsewhere. These countries (e.g. UAE and UK) are offering better incentives so volume of foreign exchange for real estate investment has dropped.

SBP has reported that Pakistan received USD 21.84 billion remittance during 2019-20. Most of the overseas investments are in the real estate sector because they face restrictions in doing other businesses. Over-regulation of the real estate sector discourages the overseas investors and may cause in reduction of remittances in Pakistan. Further the policy of non-utilization of development budgets by the government cause the contraction of the activities of this sector.

The Future of Real Estate

Apart from all the decision taken by the authorities, there were high hopes that this sector will have high growth in 2020. But the issue is much bigger this time that can potentially cause a serious crisis in the real estate markets across all big cities specifically Islamabad, Rawalpindi, Lahore and Karachi.

Increasing the tax for a potentially growing sector contributing to the economic growth like real estate sector can be damaging. Government should broaden the tax net by incentivizing of the sector first. In the current situation, government should form a revised policy for real estate sector.

Points to Ponder

Government must bring a well-structured, transparent and centralized system for investors as compared to the current complicated procedures of documentations and doubtful legal support. After giving the industry status to that industry, government should establish an industry regulator, approve rules regarding land acquisition and ownership and all property consultants and projects should be registered.

[1] My thanks to Nadeem Ul Haque for suggesting this topic and guidance through the research.

Good discussion about real estate sector issues.

Very limited work in this sector in Pakistan exists and there is need to conduct further academic and research work on this sector is essential. This is a good effort for creating awareness.

Real estate is certainly low risk investment but flow of undeclared funds in the sector bloat the prices beyond reach of small investor or end user who wants to acquire house of his own.

Need for specific regulator is a good idea to put a check on rampant mal practices wrt legal title, late or non delivery.

I congratulate Dr Fraz for writing this blog. Real estate sector have great potential to grow construction industry and as well as have huge employment capacity. This area will provide the opportunity to invest more in real estate and construction sectors.

A very good read. construction sector is so underrated in Pakistan.

This has to be probably the most problematic myth about real estate. Many willing people are often discouraged from making an investment that could easily secure their future and help them monetarily.

An interesting read. The article explicitly shows correlation between KSE and housing prices

Thank you for sharing these blogs. Very helpful and informative.

Very informative blog regarding real estate…. good job Ahmad Fraz

What should I do to start career in Real Estate

Good Information, thanks for sharing.

This article is really very helpful.Thank you for sharing these blogs.

well researched & richly informative article, I agree a lot of work is needed to be done in this area.

[…] [1] My thanks to Nadeem Ul Haque for suggesting this topic and guidance through the research. […]

Thank you for sharing this blog ,this is very informative for those who are willing to invest in real estate.

Excellent list of real estate blogs to reference, they all do an amazing job. Great article!

Market is a bubble. It is not a real valuation. 400% increase in last 10 years just does not make sense given the political and economic turmoil.

If you are thinking of buying a property in Pakistan, you have come to the right place. At Makkaan.pk you can find extensive information about available properties in every part of the country. Makkaan is a Pakistani real estate portal that offers a wide range of properties for sale and rent in Pakistan. The website has been operational since May 2020 and offers a user-friendly platform for buying, selling or renting out property in Pakistan.Makkaan buy & sell in pakistan

If you choose to invest your money with Pearl Residencia, you can rest easy knowing that it will be placed into an investment that is reliable and secure if that is what you decide to do with it. Even a relatively small financial outlay in the form of an investment in the day-to-day operations of this company has the potential to yield a significant number of perks and benefits. If you don’t actually live there, renting it out to other people could turn into a highly profitable business venture for you.

Premium Platform of Real Estate solution:

To maintain the position of being one of the most well-known top real estate agency of Pakistan is Brownstone Marketing. We strive to make effort to provide authentic and trustworthy real estate

services. Our crew excellent work with their skilled and exceptional abilities. We

eager to sustainably improve the lives of Pakistanis with the collaboration of grand

projects we will achieve our effective and innovative goals.

investing in a project like kingdom valley islamabad is always a profitable asset for living and for the investors purpose also, kingdom valley market is skyrocketing day by day!

Nice blog.Thanks for the useful information with us.

house for sale mardan

Really useful post. Thanks for sharing this

property website in pakistan

Amazing post!

home construction companies lahore

https://www.tangent.com.pk/corporate-financial-advisory-pakistan

For best Real Estate option in Pakistan must try

Best Real estate agency in Pakistan

For best Real Estate option in Islamabad must try

Best Real estate agency in Islamabad

The Park View City is divided into different alphabetical blocks consisting of commercial and residential blocks. An extension block “J” has also been launched in the society by the management in the recent balloting event held at the premises of society. Blocks A, B, F, J and K consist of 5 Marla plots while 10-marla plots are offered in Blocks A, B, F, H and I. 1-Kanal plots are available in Blocks B, C, E, F, N and M and Blocks D and P offer 2-Kanal plots in the society.

Are you searching for a best domain name too? Here is a best and cheap domain name option for you! Namecheap Inc- a cheap registrar. But, do you know what Namecheap is?

A domain registrar and web hosting company that provides a variety of products and services for both personal and business use.

Are you searching for a best domain name too? Here is a best and cheap domain name option for you! Namecheap Inc- a cheap registrar. But, do you know what Namecheap is?

A domain registrar and web hosting company that provides a variety of products and services for both personal and business use.

need to update us and this page as will

5 marla house in Murree, surrounded by lush greenery and breathtaking mountain views and located at the heart of Islamabad Murree Expressway, Musyari.

the builders of Blue World City in Islamabad have taken a great step and built a new block named Shoaib Akhtar Enclave Blue World City Islamabad .

This Article very interesting and good. If you want to check YouTube channel statistics here we provide free tool to check stats for your channel or others channels to get analysis on it.

ALL YOU NEED TO KNOW ABOUT PAKISTAN REAL ESTATE MARKET & INVESTING IN 2023

https://ozdevelopers.com/2023/04/05/all-about-pakistan-real-estate-market-investing-in-2023/

“Great insights on real estate myths in Pakistan! This blog effectively debunks misconceptions and empowers readers with accurate information. Kudos!”

The best way to get direct owner properties and to find outdistressed sellers at Xmarla.com The profit is made on buying in real estate and if we get property from the owner. it’s free from broker fees and fee fraud of dealers.

Really useful post. Thanks for sharing this

Best Property website in Pakistan

Thanks for it as this analysis provides a comprehensive view of the challenges and potential solutions within Pakistan’s real estate sector. The insights into the impact of taxes, regulations, and changing policies on the market’s performance are crucial. The suggestion to establish a more transparent and structured system, along with industry regulation, points toward a way to revive and stimulate the sector. The information presented is highly informative and offers valuable considerations for the future of real estate in Pakistan.

Amazing information. I really enjoyed reading this blog. I want to refer to https://alwarisgoc.com/silver-city-islamabad/.I hope everybody enjoys reading the blog.