by Mr. Shahid Sattar

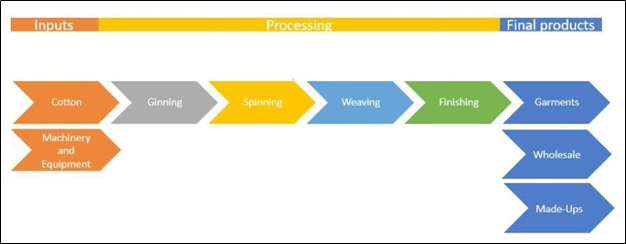

There’s no denying that the Textile Value Chain (TVC) is holding a dominating position by far in Pakistan. It varies in range from cotton production to prêt-à-porter and export. Conversion of cotton lint to a finished product is a tough row to hoe involving many actors, industrial units and processes. The fragmentation of supply chain is done in two main sectors. One is formal sector which involves spinning units (textile mills) and the other one is informal sector where sewing, knitting, clothes and towels primarily take the shape of SMEs small cottage units.

A Fragmented Supply Chain

The factors on which the sales of cotton mostly rely are the size of the cotton farm, cultivator’s access to market and producer’s financial capability. Large scale farmers generally sell crops directly. The scenario is different for small and medium scale farmers who either sell their crops to ginners or to artis (middlemen). Although the middlemen connect cotton producers with actors in the downstream of industry, they are the weakest link of the CVC/TVC because owing to their informal operation of defining prices, they adversely impact the sale price of the farmers. The ginners’ easy targets are those farmers who own very small cotton farms (less than one hectare). Due to lack of market exposure, as a last resort they sell cotton on comparatively far low prices than the market.

There is an impact of processes like picking, transportation and ginning on the quality of the Cotton. In Pakistan, the cotton is hand-picked thus making the raw waste of approximately 9 per cent while in other cotton-producing countries with machine-picked process it is about 3.5 per cent. In an attempt to reduce contamination a procedure called ‘beating’ is practiced which results in high wastage as due to excessive beating the quality of the cotton is compromised.

Modern machinery/equipment plays a vital role in gaining quality cotton and vice versa. Unfortunately in Pakistan, the farmers either lack or have little access to modern equipment and mostly are putting their efforts in manually sowing, harvesting and weed etc. Weak conveyance and archaic cotton cleaning processes are further obstructing the production of cotton in Pakistan.

Cotton Ginning and Spinning

In Pakistan currently there are 1300 ginning units. Cotton Ginning is the process of separating the cotton fibers from the cotton seeds and other pollutants like leaves etc. The raw material used by the ginners is seed cotton (Phutti) and the finished product attained is the cotton bale. Ginned cotton is a cleaner type of crude cotton, which is moved for further processing to the spinning units (a packet size of 165 to 170 kg, equal to the one bale).

The spinning industry plays a significant role in adding value to raw cotton fibers, which is an indispensable fragment of TVC. Proudly Pakistan has been ranked third amongst largest spindle networks in Asia and also is World’s fourth largest producer of yarn. Comparatively large textile units having an internal spinning plant produces higher counts of yarn for further processing than the small units. Lack of up-to-date technology in small spinning units results in producing a thread count of up to 30 for the yarn which doesn’t meet the global market’s demand for finer yarn (60-120 thread count).

Cotton Manufacturing

After spinning the subsequent phase in TVC is manufacturing which comprises of weaving, knitting and finishing. Weaving, knitting and printing are among the most relevant sub-sectors of the TVC, while fabric, dyes and chemicals are frequently overlooked in regard of exports and policy making.

In order to address the issues of smooth cotton supply to the textile industry and to encourage quality research in cotton and textile sector, the Pakistan Central Cotton Committee (PCCC) was constituted. To keep the PCCC running a tax called “cotton cess” which is Rs. 50/bale on the export or local consumption of cotton is collected from textile mills. However, regrettably the PCCC failed to launch new seeds qualities due to lack of proper research. This failure calls for an urgent and immediate action by the government for restructuring of the PCCC with the support of private sector stakeholders.

Policy

In Pakistan the current policies are impeding the exporters from attaining imported inputs at global prices and meeting the international standards. However, the solution to the aforementioned problem of enhancing access and affordable higher quality inputs could have been the reduction in levied tariff on textiles and by improving the DTRE programme. Regional Competitors are leading their textiles by practicing so. For instance, Sri Lanka excluded all import tariffs on textiles in order to increase effectiveness in the apparel industry. Similarly Bangladesh’s Special Bonded Warehouse (SBWS) system allows all exporters in all sectors of Bangladesh to rapid and duty-free access to all the imported inputs. The scheme has about 4,500 licensed users and the SBWS agreement is mainly responsible for its success for textile and apparel manufacturers in Bangladesh.

In TVC, indirect exporters confront many complications such as poor quality and high cost of production due to lack of inadequate links between the upstream cotton industry and the downstream textile industry. The cost of production is higher for indirect exporters as compared to regional competitors because of absence of modern technology and efficient machinery as well as lack of access to subsidized credit. Thus, investment is required to strengthen the entire value chain. Investments in the country’s textile industry have been shrinking owing to high cost of business and as a consequence, the industry has lost technical advantage over its competitors. On account of slim margins and deficiency of profitability, over the last five to six years the textile sector has failed to acquire capital required for enhancing the industry.

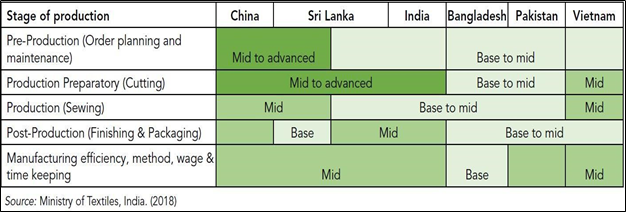

At each point of production, a review of the existing technologies is given below. Pakistan has the lowest technology after Bangladesh, while the technology of Sri Lanka has been much higher, particularly in pre-production and preparation phases.

Prevailing Scenario

Notwithstanding that the indirect exporters supply their goods at every phase of TVC, they are not entitled for any subsidized credit or refunds. In order to achieve price competitiveness and product diversification, the facilities like subsidized credit, DTRE, manufacturing bond etc should be made available to indirect exporters in addition to extending Temporary Import Schemes (TIS), SBP and LTFF schemes. For stimulating investment initiatives in garmenting projects, the LTFF be allowed for building infrastructures for garment plants.

Preceding the prevailing pandemic scenario due to COVID-19, the chances of economic recovery in Pakistan were looking bright mainly due to outsourced sectors of economy. The country was progressing in terms of growth, exchange rate stability and favorable performance in worldwide business performance metrics.

Exports

China being the origin of the pandemic outbreak faced seizure of production activities and resultantly Pakistan experienced an upsurge in export demand from foreign purchasers. In comparison to its competitors like Bangladesh where the export collapsed to 20% of its normal value, Pakistan had enjoyed favorable trade balance regarding export orders/shipments from textile sector.

A decline of more than 60 percent was observed in Pakistan’s textile exports in April 2020 due to outburst of COVID-19 and lockdown. Similarly, the exports of other regional competitors also slumped, for instance, the ready-made garment exports of Bangladesh in the month of April 2020 declined by 85 percent as compared to corresponding month of the last year. Orders of $ 3 billion dollars cancelled in one month and exports in three months of pandemic are likely to fall by approximately $ 5 billion. Similarly, Vietnam’s exports of garments are expected to drop by 34 percent over the rest of the year rather than the expected growth of 50 percent prior to pandemic. Moreover, the Corona virus has generated a crisis as a result of which even in India the export of textile and garments is likely to decline by 40 per cent.

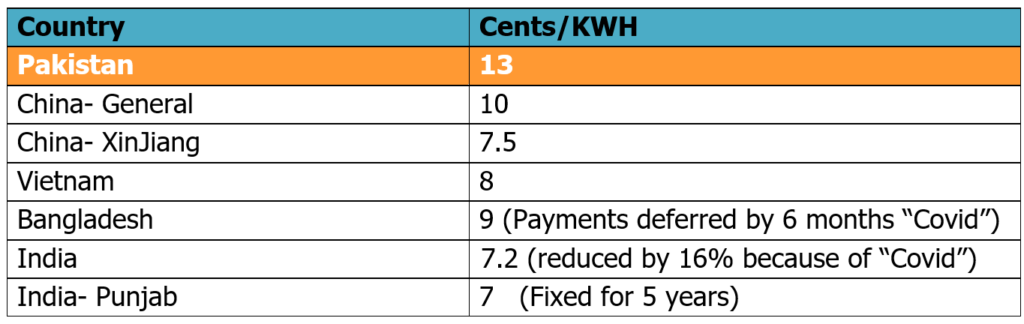

Energy

Energy is of utmost importance in the input chain as it constitutes 35 per cent of conversion cost of the final product in textiles. In order to sustain textile industry in Pakistan there is a dire need of reduction of energy prices as the same is happening in other countries. Though, in the existing system the average fuel cost is of Rs. 4/kwh while the selling price is Rs. 21/kwh, however, still it is incapable of meeting costs.

It is pertinent to mention here that only 25 percent of textile products are being sold in local markets while the rest are exported. Owing to disaggregated nature of the industry, it is not possible to distinguish production for domestic or export markets. It is need of the day to reduce the energy rates for all units as a consequence of which there will be upsurge in competitiveness of our domestic market with imported goods and support “Made in Pakistan”.

Last but not least, as some Pakistani firms are being owned domestically and vertically integrated therefore, activities like designing and branding can boost up the textile sector of Pakistan. In comparison to regional competitors, there is higher probability of extending upstream activities like design and brand development. Pakistan has more chances of targeting market segments in regional countries where there are less market saturation by global brands and are having common cultural traditions. For survival, Pakistani firms should take the plunge towards product diversification and suppliers must lead in restructuring marketing strategies for post virus scenario. The Draft Textile Policy which is principally approved by Prime Minister has charted a vision and enactment schemes for a sustained increase in exports and implementation will pave the way for a sustainable Balance of Payments and real growth in the economy.

Pretty! This was an incredibly wonderful article. Thanks for providing this info.

MK Textiles Corp,Explore MK Textile Mills, a cornerstone of Pakistan’s textile industry known for its commitment to quality and innovation. With a rich heritage and cutting-edge manufacturing facilities, MK Textile continues to lead the sector, offering a diverse range of premium fabrics and setting industry standards for excellence. For More Information Visit MK Textile’s Official Website