Cities Pay Taxes

Major Cities Paying Income Tax

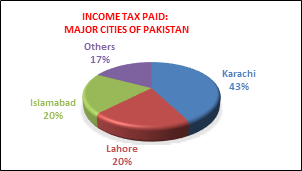

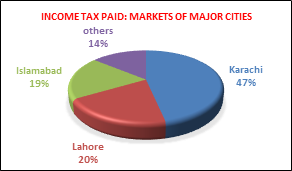

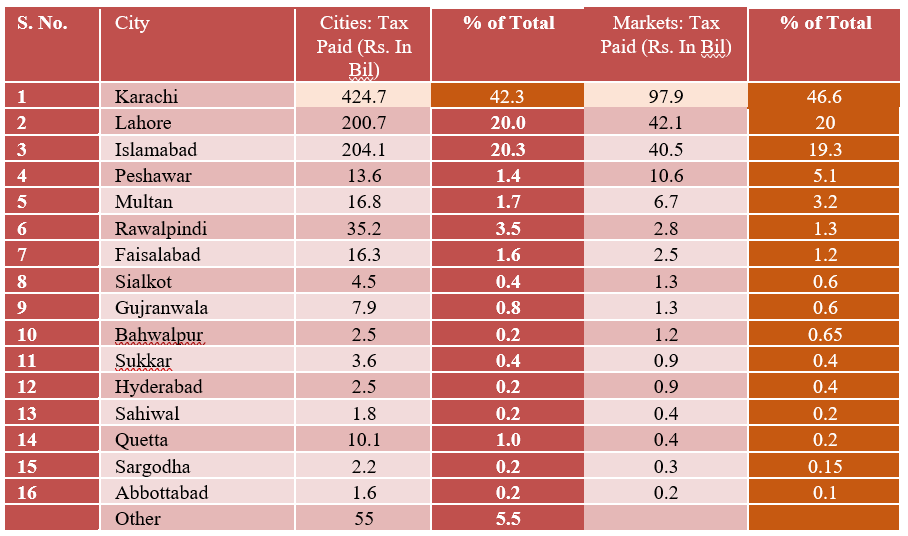

FBR has recently published a tax directory of income tax collected from parliamentarians, businesses, individuals, cities, and markets. This tax directory 2018 shows that income tax of PKR 1.03 trillion was collected from the major cities of Pakistan in 2017-18. Out of this, 80% came from three cities, namely Karachi, Lahore, and Islamabad. The directory also shows that the income tax of PKR 210 billion was collected from major markets across the country in 2017-18. Of this amount, again, a large part (86 percent) was collected from the markets of the three cities, i.e. Karachi, Lahore and Islamabad.

As income tax is paid against income earned, it is hard to miss an inference from the statistics just mentioned – economic activity occurs primarily in cities, rather in metropolises. Enormous literature on cities supports this assertion (See for example, Haque and Nayab, 2007, Haque, 2015). One reason for the higher tax collection of the three cities is that the FBR shows taxes paid by a company that operates in multiple cities, in the company’s head office city.

Corporations and Big Cities

However, the very fact that companies prefer to locate their headquarters in Karachi, Lahore, or Islamabad has implications. On the other hand, the relatively lower tax collection from the markets of Faisalabad, Gujranwala, and Sialkot, despite its cluster reputation, also has implications that researchers should investigate. Hassan and Chaudhry (2018) also wonder why tax collection from the cities of Faisalabad along with the ‘Golden Triangle’ of Gujranwala, Gujrat and Sialkot is appallingly low? (Table 1).

The markets of Karachi generated almost half of the income tax paid by major markets of Pakistan (PKR 97 billion – 47 percent). This is despite the limitations of a poor law and order situation and not-so-good civic infrastructure that Karachi has faced for decades; imagine the trading volume and taxes that can be generated if the city is unconstrained. The markets of Lahore and Islamabad pay respectively 20.0% and 19.3% of the total tax collected from the major markets of Pakistan.

Tax Filers in Markets

Karachi-Saddar alone generates income tax of PKR 77 billion (79% of total income tax paid by markets of Karachi). Even more surprising is that Blue Area alone accounts for PKR 39.9 billion (98.5%) paid by Islamabad markets. These figures lend an implication – economic activity occurs in dense and easily accessible markets. Those familiar with these two cities also know that the two markets are easily accessible and dense.

The tax directory also gives the number of filers in each market. The average income tax per filer or per entrepreneur in the markets of Karachi is PKR 0.91 million. Income tax paid per filer or entrepreneur in the markets of Islamabad is around PKR 5.0 million. If, whatever profit the income tax of PKR 0.91 million reflects, is normal profit and is enough for an entrepreneur to survive in business, then clearly the entrepreneurs of Islamabad are reaping excessive profit. Why aren’t more entrepreneurs rushing to get a slice of the fairly large profits entrepreneurs of Islamabad (especially those doing business in the “Blue Area”) seem to enjoy? The answer could be hidden in Islamabad’s limited retail space: limited space has made property too expensive in the city. Expensive property represents a barrier to entry. Overcoming this barrier requires a significant capital investment.

Let Our Informal Markets Work Too

Peshawar’s Karkhano Market, which is the largest Bara market in the country, generates an income tax of PKR 5.3 billion. Markets specifically named Bara markets in other cities collectively generate income taxes of PKR 60 billion. The markets called landa bazzar and kabari market collectively generate PKR 353 billion. The lesson from these figures is that the informal sector contributes to the economy, so let it exist.

Rawalpindi, which has a population of 5.41 million, its markets pay an income tax of PKR 2.82 billion. But Multan, which has a smaller population of 4.75 million, has markets paying income taxes of PKR 6.67 billion. That is PKR 3.82 billion more than Rawalpindi. One explanation could be that Multan being the largest, most developed city in South Punjab, caters mainly to its residents. On the other hand residents of Rawalpindi and various other parts of the country appear to be shopping in Islamabad. These inferences carry worth pondering implications for city development.

The Corporate Front

On the corporate front, a total of 44,609 companies filed tax returns, together paying income tax of PKR 497 billion. 55% of the companies paid no tax and 20% paid less than one lac Rupees as income tax. Of over 44,000 filer companies, just 600 companies paid 81% of the total income tax paid by the corporate sector. The top 5 tax-paying companies contributed PKR 60 billion.

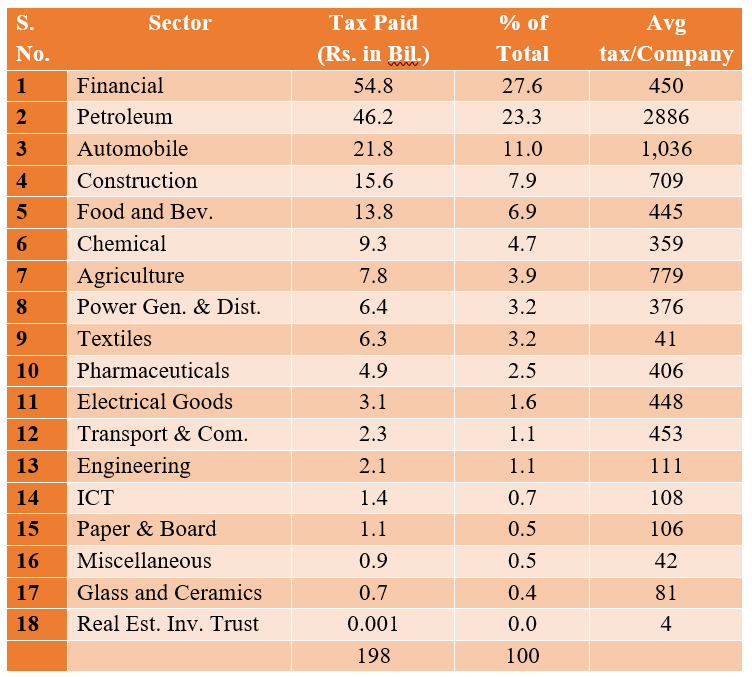

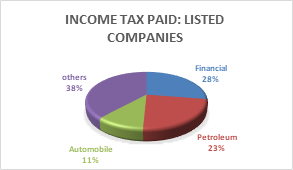

The 542 companies listed on stock exchange generated income tax of PKR 198 billion. 98% of this came from 150 companies. Out of the 542 listed companies, 147 (27%) companies paid no tax. The textile sector with 153 listed companies is the largest sector in terms of number of companies. Ironically, the sector contributes only 3.2% of the total income tax collected on the stock market. The two sectors that pay the most income tax are the financial sector (PKR 54.9 billion) and oil and gas (PKR 46.2 billion). Listed companies included in these two sectors collectively paid PKR 101 billion. This is 51 percent of the total income tax collected from the stock market.

Most (60%) of corporate income tax comes from unlisted companies. 27% of listed companies pay no tax, while 98% of tax paid by listed companies comes from only a small fraction. 28 percent of listed companies paying 51 percent of tax contributed by only two sectors – financial and oil & gas. All of this unambiguously says one thing: Pakistan’s stock market is very shallow.