Does Free Market Mechanism Offer a Win-Win Situation to Wheat Consumers and the Government?

Does Free Market Mechanism Offer a Win-Win Situation to Wheat Consumers and the Government?

ABEDULLAH, Chief of Research, Pakistan Institute of Development Economics, Islamabad.*

| Government of Pakistan intervenes in wheat marketing to offer low prices to consumers and to encourage farmers by announcing support prices. Government procures about 25-30 percent of total wheat production and leaves only 10-15 percent for the private sector. This practice does not only cost Government on an average Rs.48 billion per annum, but also creates a circular debt of Rs.757 billion, implying that it is not a sustainable intervention. This policy view point attempts comparing the existing situation with free market mechanism for the year 2020. Our analysis revealed that if Government would not intervene in the market, then farmers would be getting higher prices and consumers would be enjoying at least 25 percent lower prices than the current prevailing price levels. Moreover, Government would also be saving Rs.48 billion. It clearly implies that free market mechanism could lead to a win-win situation for all stakeholders, i.e. consumers, producers and the Government. |

Wheat Economy in Pakistan

Wheat is the most important agricultural crop of Pakistan. It is grown by 80 percent of farmers and planted on about 22 million acres, which is approximately 40 percent of the country’s total cultivated land. Punjab plays a major role in wheat production by allocating 16.14 million acres (71.5 percent), followed by Sindh, KPK and Balochistan with almost same trends in production also (AMIS, 2020). Wheat also contributes 37 percent to both food energy and protein intakes. Being a staple food, it accounts 72 percent to the food basket of Pakistan, with the highest per capita consumption of 124 kg per person per annum in the world.

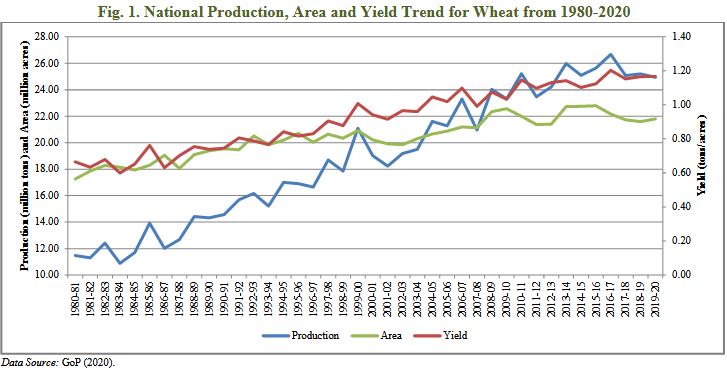

A significant increase in the wheat production has been observed in the past four decades i.e. from 11 million tons in 1980 to 25 million tons in 2020, while, during this period, the area under wheat has increased from 17.2 million acres to 21.8 million acres (Figure 1). The yield was increased by more than 75 percent during the period at an average growth of about 2 percent per annum, while area was increased at about 0.65 percent per annum. This implies that improvement in technology (high productive seed) and improved management practices played a major role in increasing the wheat production-reflecting the contribution of research in agriculture sector in improving the food security situation in Pakistan. Wheat production is continuously increasing with fluctuations but growth rate is comparatively low. However, sustainable wheat production is essential to ensure national food security. But increase in population, poor wheat productivity and fluctuations in retail prices of wheat have made it challenging for the Government to achieve this goal.

__________________________________

Acknowledgement: I am highly thankful to Mr. Yahya Khan, MPhil. Student, Department of Environmental Economic for providing some basic information used in this article.

Wheat Production Targets and Support Prices

Government of Pakistan fixes wheat production targets and the minimum support price, ahead of the Rabi season. Government’s Federal Committee on Agriculture (FCA) had set a wheat production target of 27.03 million tons from 22.73 million acres for Rabi (2019-20). Ministry of National Food Security and Research with the support of its allied institutions had fixed the minimum support price for wheat at Rs.1400/40kg (Rs.35/kg) for Rabi (2019-20). However, the Chairman of Agriculture Forum of Pakistan (AFP) had warned the Government that it would be hard to achieve such a big production target as farmers had planted wheat only on 21 million acres due to high cost of production and low support price offered. This indicates that Government may miss the production and procurement targets and it should plan for the alternatives to stabilise wheat supply with minimum price fluctuations well before the crisis arises.

Wheat Marketing

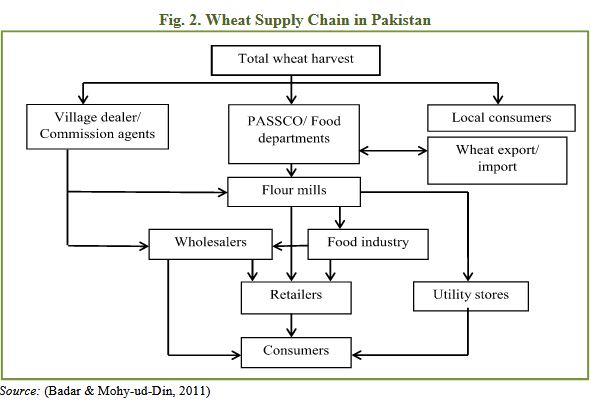

Wheat marketing is a multistep process that starts from sale of wheat grains from farmers’ fields till it reaches to the consumers in the form of wheat flour. Three modes of supply lead from the farm; village dealer, Pakistan Agricultural Storage and Services Corporation (PASSCO) and the local consumers (Figure 2). Apart from wheat used for exports, the rest is sold to the flour mills for processing. After milling, the processed wheat (wheat flour) is supplied to various wholesale markets and retailers that make it convenient for the local consumer to buy from. A large part of this supply chain is managed by PASSCO, which supplies wheat locally and internationally.

Private traders (district/village brokers or beoparis) also buy directly from farmers. Instead of bringing directly to public procurement centers, a large number of farmers sell wheat to middlemen such as village shopkeepers and village brokers (beoparis). Village brokers (beoparis) and commission agents (arhtis) collect wheat from growers and deliver it to millers and wholesalers (Khan, 2014).

After the 18th amendment, provincial Governments become responsible to procure wheat from the farmers at minimum support price and to release it to the flour mills at the fixed price. Wheat prices and movements are managed at the provincial and district levels. The farming community of Pakistan annually retains 60 percent of the wheat production for seed purpose and domestic consumption. To meet food security goal, Government ensures procuring wheat between 25–30 percent of the total production, while the remaining 10-15 percent is left for purchasing by the private sector. Provincial Governments should procure wheat according to their demand. But this requires financial resources, for which Provincial Governments are reluctant to spare especially small provinces. Finally, this additional burden comes at the shoulders of the Federal Government to procure wheat and stock it for the whole year.

Situation Analysis of Wheat Shortage

For the market year 2019-20, the demand for wheat was estimated at 25.5 million tons against the actual production of 24.3 million tons, indicated a supply shortage of around 1.2 million tons. The low planted acreage, unseasonal heavy rains, yellow leaf rust, and locust outbreak also affected the local production abruptly.

The wheat stocks, held by provincial food authorities and PASSCO, at the end of March 2019 were 4.5 million tons, which were about 38 percent less compared to 7.3 million tons in March 2018. Initially Government planned to export 0.6 million tons during

2019 but by looking at supply shortages, Government banned the wheat export in October 2019. Market was also signaling of increase in prices in days to come because private sector including flour mills started to offer higher prices to farmers than the minimum support price to procure wheat for their consumption. Therefore, PASSCO and provincial food departments did not able to achieve the cumulative procurement target of 7 million tons.

This year millers also negotiated to produce lower extraction ratio of 65:35, i.e. 65 percent wheat flour and 35 percent byproducts instead of 80:20, which lead to decline in supply of wheat flour in the market. This also aggravates the supply-demand situation of wheat flour and pushes the prices upward.

The official statement that Pakistan has missed its wheat production target by 1.6 million to 1.8 million tons generated clear signals for the speculators to hoard wheat. Moreover, it also informed international wheat suppliers that Pakistan would be a captive buyer, resulting in an increase of international wheat prices. The ongoing wheat crisis calls for smart solution on sustainable agricultural practices through free market mechanism.

Costs to the National Exchequer for the Interference in Wheat Market

Wheat costs to the Government in terms of support price, procurement, storage, and subsidising grains to flour mills. In order to procure 30 percent of total wheat production (7.3 million tons) at the rate of Rs.35/kg, Government requires Rs.255 billion (=7.3*1000000000*35). If Government would have to borrow this amount from banks at the ongoing interest rate of 7.4 percent for one year and plans to repay principal amount in monthly installments of 10 months through selling wheat to flour mills, then Government would pay interest amounting Rs.11.8 billion. Besides this, Government would require additional financial resources of Rs.36.2 billion for handling, transportation and storage costs incurred by the PASSCO at the rate of Rs.4.96/kg (Dorosh, 2012). This implies that Government would require total financial resources of Rs.48 billion (=11.8+36.2) to interfere in the wheat market for maintaining the retail price close to the minimum support price (Rs.35/kg). Government involvement in wheat marketing over the years has created a circular debt of Rs.757 billion (Suleri, 2020). This implies that Government inference is not sustainable. Such market intervention by the Government is not only costly but it also discourages the private sector to effectively participate in the wheat procurement and marketing. If Government strongly regulates the wheat market through releasing stock to flour mills for maintaining the prices at the minimum level, then private sector cannot survive as no incentives left to get involved in the wheat marketing.

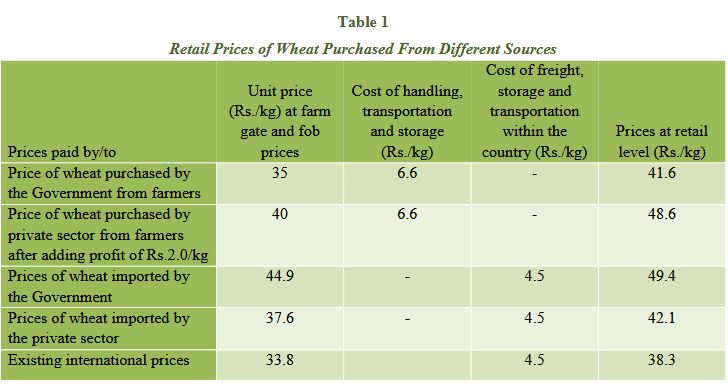

However, if Government stops interfering in the wheat market and allow the private sector to participate in wheat marketing, then the cost of national exchequer, i.e. Rs.48 billion would have been transferred to the consumers in terms of higher prices. This would lead to surge the retail prices of wheat by 16 percent (Rs.41.6/kg) against Government wished price (Rs.35/kg) (Table 1). Since, the private sector was competing with the Government in procuring wheat from the farmers; they offered higher prices to farmers (Rs.40/kg). Therefore, from the perspective of private sector, the retail prices of Rs.46.6/kg would be justified. Even if we add a profit of Rs.2.0/kg of private sector then prices will remain close to Rs.49.0/kg. We believe, it is bearable for consumers because current retail prices of wheat are varying between Rs.60-65/kg. Through market intervention and putting barriers on import and export, Government create wrong signals, which lead to high fluctuations in the wheat prices.

Despite the recent signals of wheat shortage started appearing at the time of harvest (March-April 2020), the private sector was not allowed to import and thus prices continue to surge through supply-demand mechanism. On the other hand, Government also did not timely decide to import wheat, which resulted in consumer’s suffering in terms of paying higher prices. If private sector is free to decide when and how much wheat to be imported, then import orders would have been placed much earlier and speculation of wheat shortage would not push the wheat prices vertically upward. Thus, prices would have been settled at much lower level than the current history- high levels. Moreover, delays in import also created signals for the international market that Pakistan is facing serious shortage of wheat and country is going to import (at very short notice) large amount of wheat to fill the gap between supply and demand. It also pushed the international prices upward compared to the normal situation.

Recent Import and Comparison with Open Market Scenario

Government decided to import 0.840 million tons of wheat in the beginning of October 2020 and also allowed private sector to import 1.09 million tons till January 2021. More than 120 importers have shown interest to participate in wheat import (ECC, 2020), implying that private sector is keen in wheat marketing if the required space is provided.

The public sector has purchased 0.18 million tons of wheat from Russia at US$279/ton (Ahmed, 2020), which is equivalent to Rs.45/kg. If we add Rs.4.5/kg freight and other transportation charges to arrive wheat at buyer’s premise, then retail price will be Rs.49.5/kg. It is only Rs.0.8/kg higher than the retail prices if Government would not have interfered in the local wheat market. However, the current retail prices are Rs.60- 65/kg in the market because of imperfect competition and little space provided to private sector to operate in wheat marketing. This implies that after reaching the imported wheat in the local markets, prices are expected to decline by Rs.10-15/kg. On the other hand, private sector has made an agreement to import 0.33 million tons of wheat at US$233.8/ton (Ahmed, 2020), which is 16 percent less than the import price paid by the Government. After adding same freight and transportation charges, the retail prices of wheat imported by private sector will be Rs.42.1/kg. It is slightly higher than the retail price (Rs.41.5/kg) of locally purchased wheat by the Government but significantly less than the retail prices of local wheat (Rs.48.5/kg) purchased by the private sector (Table 1). Due to expensive wheat import by the Government, a high price of Rs.49.4/kg is expected to prevail in the local market, which is 24 percent less than the current prevailing price of Rs.65/kg.

Both the public and private sectors imported wheat at higher prices compared to the prevailing (US$210/ton) international wheat prices (Business Insider, 2020). It might be because of shortage of time that importers could not properly explore the international wheat market. If wheat would have been imported at US$210/ton, then retail prices of imported wheat would be Rs.38.3/kg, which is significantly less than the retail prices of locally procured wheat by the Government and the private sector (Table 1).

Our analysis clearly demonstrates that retail prices of imported wheat by the private sector are less than the local wheat procured both by Government and private sector. International wheat prices are slightly less than the farm gate prices in Pakistan and when we are adding the cost of handling, transportation and storage, then retail prices of local wheat become higher than the imported wheat. This simple analysis provides empirical evidence that if Government would not have interfered in free market mechanism, then retail prices would not have increased to Rs.65/kg rather maximum price of wheat would have settled close to Rs.49/kg. Moreover, Government can save Rs.48 billion per annum being spent on wheat procurement, handling, transportation, and storage to maintain floor prices.

Future Strategy

In the current year, Government strongly intervenes in the wheat market by fixing support price and releasing stock but still could not stabilise wheat flour prices. Rather prices continue to increase to almost double than the minimum support price fixed by the Government. Moreover, the benefit of price increase is neither enjoyed by the farmers nor the Government, rather it has gone into the pockets of the traders. We, as economists, certainly believe that free market mechanism will not allow emerging such super-profits for the traders. Before emerging wheat crisis, the private sector will start importing wheat to exploit profit, which will pull the price down.

It is hereby suggested that Government should completely withdraw restrictions on wheat trade and allow the private sector in buying it from the farmers and supplying wheat flour to the consumers. Moreover, farmers can participate in the wheat marketing and can stock their produce according to their future anticipations about wheat prices. They can also directly supply wheat to the market at the prevailing market prices. If at harvesting stage, local prices start to increase beyond the international prices, then the private sector will automatically be motivated to import from the international market due to arising economic incentives, which would ultimately eliminate wheat crisis and allow consumers to enjoy low prices.

REFERENCES

Amin, A. (2020). Dawn October, 10, 2020. https://www.dawn.com/news/1584265/ample-wheat-stocks- available-says-fakhr.

AMIS, 2020. Agriculture Market Information Services (AMIS). http://www.amis.pk/

Badar, H., & Mohy-ud-Din, Q. (2011). Marketing of Agriculture Products in Pakistan: Theory and Practice. Higher Education Commission of Pakistan. Retrieved from https://www.researchgate.net/publication/229059737_Marketing_of_Agriculture_Products_in_Pakistan_The ory_and_Practice

Business Insider (2020). Market Insider, Wheat. https://markets.businessinsider.com/commodities

Dorosh, P. (2012). Pakistan Wheat Procurement Policy Reform. Presented in Workshop “Productivity, Growth and Poverty Reduction in Rural Pakistan” organised by Pakistan Strategy Support Program (PSSP). First Annual Conference December 13-14, 2012 Islamabad, Pakistan.

ECC (2020). Economic Coordination Committee (ECC) directs Ministry of NFSR to accelerate efforts for wheat imports. https://mettisglobal.news/ecc-directs-ministry-of-nfsr-to-accelerate-efforts-for-wheat-imports.

GoP (2020). Pakistan Economic Survey, 2019-2020. Government of Pakistan, Finance Division, Islamabad.

Khan, A. S. (2014). Pakistan’s food security from wheat value chain perspective. The University of Auckland.

Suleri, A. (2020). Wheat and Inflation. October 21, 2020. The daily News. https://www.thenews.com.pk/print/732353-