Doing Taxes Better: Simplify, Open And Grow Economy (PIDE Policy Viewpoint 17:2020)

Doing Taxes Better: Simplify, Open and Grow Economy[1]

All experts agree on:

Simplify Taxes, Reduce the costs of excessive Documentation, Open the

Economy for High Growth and Employment. Taxes too will then Increase.

Taxes have been the cornerstone of IMF-led adjustment programs for Pakistan for over four decades. During this period, long term growth and productivity have declined while tax policy has become more contentious and fragmented. Measures multiply as unrealistic targets are chased with mini budgets every quarter. The following arose from a high-level conference arranged at PIDE to clarify future directions in tax policy.[2]

Illusive Targets: Chasing Tax GDP Ratio through Arbitrary Measures

For decades now, policy has sought to give priority to increasing tax-to-GDP ratio leaving growth and employment to an outcome perhaps of some projects funded by the Public Sector Development Programs (PSDP).[3] Expenditures are never reviewed or rationalized for efficiency. Public sector employment is guaranteed, and annual wage increases are held sacrosanct while operational expenditures are regularly cut. Arbitrary and frequent tax changes have created an environment of uncertainty while cuts in operational expenditure have led to “austerity.”

| BOX 1: The Principles of Tax Policy Transactions must be allowed to grow while collecting taxes. All taxes will create dead weight losses and market distortions. Good policy must seek to minimize these. A tax effort that kills transactions is self-defeating. More transactions mean higher economic growth and employment, which in turn will generate sustainable streams of revenues. Fairness: No one group should be seen to be bearing more taxes than others. This does not mean redistribution cannot be achieved through tax policy, but it must have an explicit and well thought out plan. Certainty: Since taxes distort prices and market activity, there must be certainty in policy for people to build businesses. Frequent and arbitrary taxes are harmful for growth. Efficiency: The process of collection should not involve further losses and transaction costs on economic agents. One inefficient manner in which government taxes people is through the use of excessive regulation such as curbing economic activity or state ownership of market resources and activities. Convenience: Excessive documentation requirements also add to the tax burden to hurt growth and employment.Taxes and their administration should not be onerous especially in the daily activities of people where the bulk of the economy lies. |

______________________

[1] Special thanks are due to Dr. Nadeem Ul Haque for motivating us to work on the topic, and guiding and mentoring us throughout the project till its end. We also thank Dr. Ikramul Haq and Ms. Huzaima Bukhari for their comments on an earlier draft.

[2] The Pakistan Institute of Development Economics (PIDE) organized a conference on the state of tax policy in Pakistan on March 11, 2020. The focus of the conference (see Box 8) was to generate a debate on shifting the paradigm of tax policy and administration to make it growth oriented. The discussion focused on issues in tax and tariff policies, along with examining the role of automation and documentation in promoting growth and competitiveness.

[3] PIDE has already developed a book (Haque et al, 2020) as well as a policy viewpoint on the subject to note that our growth policy remains framed in the now obsolete Haq/HAG model.

https://forms.gle/UCqHjnwU4AZPPYXRA

https://file.pide.org.pk/pdf/Policy-Viewpoint-11.pdf

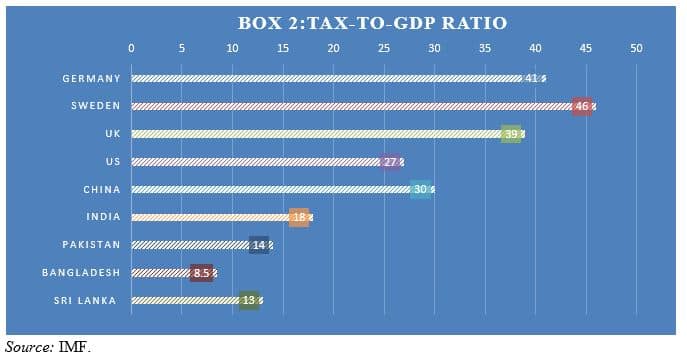

Increasing the tax-to-GDP ratio regardless of how this has become the cornerstone of policy. The narrative that the government and donors have established is that Pakistan has a tax-to-GDP ratio lower than some other group of countries. Box 2 shows tax-to-GDP ratio for a select group of countries. It clearly shows that even in advanced countries, this ratio can vary by as much as 15 percentage points. Pakistan’s tax-to-GDP ratio of 14% is not way out of line with the region: Sri Lanka (13%), India (18%) and Bangladesh (8.5%).

Tax Policy is Killing Transactions

Most experts are of the view that Pakistan tax policy is not based on these well-known and clear principles (See Box 1).[4] Section 5 of the Federal Board of Revenue Act legitimizes a Tax Policy Board/Committee to sketch tax policy independent of FBR. Unfortunately, that board convened only once after reconstitution. The finance bills that continually add ad-hoc tax measures in frequent mini-budgets have developed a complex tax system that confounds principles of rational tax policy.

Data shows that policy consistently pushes for an unrealistic tax-to-

| BOX 3: Are We a Tax Cheating Nation?? The gathering challenged the prevailing official narrative of tax cheating nation. In the current withholding tax regime, every mobile phone user (i.e. 90% of population) is paying income tax in withholding form. This narrative appears to be unique to Pakistan. Countries such as Indonesia with a lower tax-to-GDP ratio does not accuse its citizens of tax cheating. It is strange indeed that even as FATF and international community are breathing down our neck our officials are claiming that their policy and administration is not at fault; it is the people who are cheats. |

________________________

[4] See Haque, N. Macroeconomic Research and Policy Making: Processes and Agenda. https://file.pide.org.pk/pdf/Macroeconomic-Research-and-Policy-Making-Processes-and-Agenda-Dr-Nadeem-ul-Haque.pdf

GDP ratio, setting the FBR to chase the number with arbitrary measures that kill transactions. The current target of the IMF for a tax-to-GDP ratio of 16.7% by FY 2021-22 is unrealistic and cannot be achieved without enhancing the taxable capacity of the country. Yet curiously the design of the target, and measures to achieve it have stifled economic activity. As in the rest of the world, for revenues to increase we need economic growth. Yet policy is killing transactions through arbitrary taxes and costly documentation drive.[5]

Arbitrary Minibudgets and Fragmented Sales Tax have increased Uncertainty

Not only is our tax policy not based on conceptual clarity, it is also being changed continuously to meet unrealistic targets. The tax rates are high and keep changing several times a year through exemptions and SROs in mini budgets. The uncertainty due to continuous tax changes are a huge drag on investment which as a percentage of GDP is already among the lowest in the world.

Similarly, the sales tax base is fragmented with services subject to taxes at the provincial level and goods at the federal level. There is also variation in rates (from 1% to 17%), in addition to several exemptions. The standard rates on services also vary between provinces. In Baluchistan and KPK it is 15%, in Punjab it is 16% and in Sindh it is 13%. Such fragmentation and exemptions also add to the existing uncertainty[6].

Tariff Policy has Strangled Competition and Growth

Openness has been seen to be important for growth. In 1970s Pakistan adopted the local industry protection policy while Chile and Turkey liberalized their economies. The countries that adopted openness – Turkey and Chile — saw sustained growth and their manufacturing sectors developed. Turkey even joined the European Customs Union in 1995. These countries are now exporting value added goods like machinery and automobiles. Similarly, Vietnam started liberalizing in 1986. They started rationalizing tariffs and went for privatization. In 1995, their exports were equal to that of Pakistan and which are now ten times higher in 2020. Since we did not lower tariffs, we could not integrate into the global value chain.

______________________

______________________

[5] See Haque, N. Kill Transactions, Kill Economic Growth. https://medium.com/@nadeemhaque/kill-transactions-kill-economic-growth-5b45ae75abc1

[6] See Huzaima & Ikramul Haq, Overcoming fragmented tax system, Business Recorder, October 19, 2018.

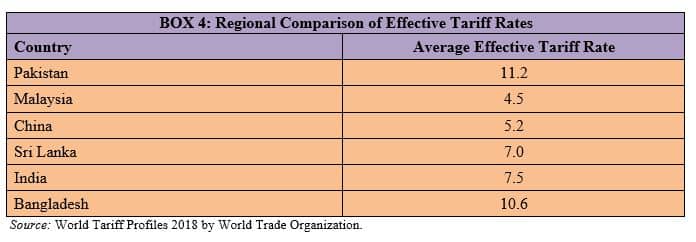

Pakistan, on the other hand, continued to follow the policy of protectionism. The average effective tariff rate in Pakistan is the highest in the region (see Box 4). With high protection, the competitiveness and quality is virtually eroded. Protectionism, especially for the manufacturing sector, is the standard policy of the government. Manufacturers enjoy exemptions and concessions on the import of these items which if imported by others are liable to duties etc. Consequently, the local manufactures neither developed their capacity nor upgraded technology to bring in quality for their captive market. The unprecedentedly high (52-90 %) duties on raw material reduce the share of manufactured goods to 0.15 % in Pakistan as compared to 25 % and 50 % in India and Vietnam respectively.

Excessive Documentation is Killing Economy

Not only is the tax system complex, the cost of compliance is high. Taxpayers are also discriminated on the basis of being filer and non-filer. Higher taxes, narrow base, differential treatments, and exemptions become hurdles in achieving growth and employment and block flow of revenue.

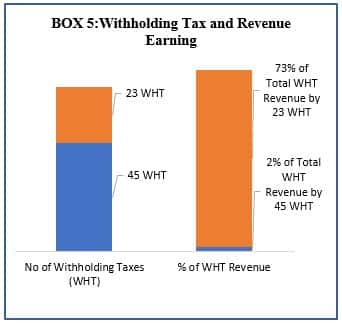

The withholding regime is imposing costs on business and individuals. There are 66 withholding taxes which furnish almost 3/4th of direct tax revenues. However, 45 of these withholding taxes provide only 2% of the revenues from this source (see Box 5).[7] About 70% of tax revenue is collected through withholding tax agents such as banks, utilities, telecom etc. placing the burden of collection on these businesses and increasing their costs. While these withholding taxes may provide an easy source of collection for Federal Board of Revenue (FBR), they make the tax system incredibly complex for the taxpayers. This also questions the role of FBR as a tax collecting authority.

The current documentation drive would prove ineffective and rather counterproductive in the presence of high cost of compliance. This cost consists of the number of hours required for record keeping, tax planning, and forms completion and submission. It takes around 577 hours (per year) to complete the tax payment process in Pakistan compared to the world average of 108 hours. Adding this to the high number of payments (47) tremendously increases the average tax burden in the country.[8] The high compliance cost imposed on businesses being the unpaid tax collectors for the government is the very reason for tax non-compliance. In such an unconducive environment, the current documentation drive would kill transactions – and with it any hopes of increasing economic growth and sustainable revenue streams.

______________________

[7] Kardar, S. H. and Pasha, H. A. (2020). “Tax reform agenda”, presented at PIDE One Day Conference on ‘Doing Taxes Better: Shifting the Paradigm of Tax Policy and Administration’ held on March 11, 2020.

[8] http://documents.worldbank.org/curated/en/143331468313829830/pdf/886380WP0DB20100Box385194B00PUBLIC0.pdf

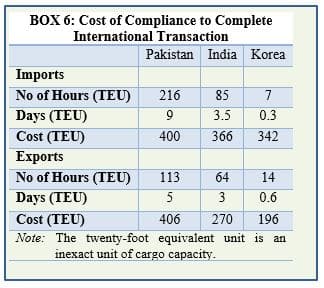

An intriguing example of the high compliance cost for meeting the documentary requirements can be observed in Customs. To complete an international trade transaction, we require more than 400 hours (17 days). India and Korea, on the other hand, require 270 and 194 hours, respectively (see Box 6 for details). Hence, reduction in transaction time should be an important objective.

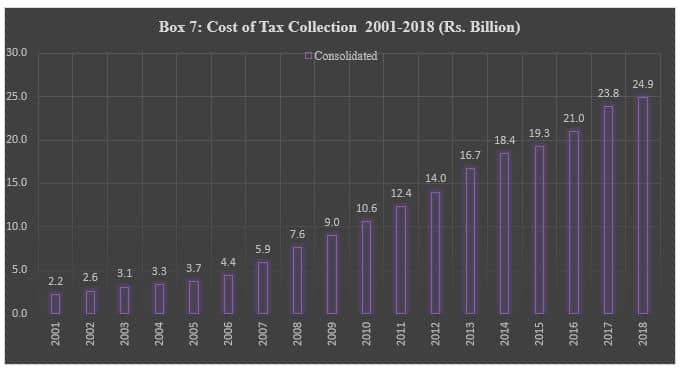

The price of tax collection is also very high in Pakistan (see Box 7). The cost of collection (CoC) has sharply increased over time. It has increased from Rs. 16 billion in 2014 to Rs. 25 billion in 2018, representing 36 percent increase in cost during the short span of 5 five years. Higher CoC leads to lower benefit of revenue collections. Nearly 80 percent of CoC is distributed in the form of wages of tax collection staff. Tax expenditures have been estimated in a study by FBR to be about 1.2 trillion rupees, about 4 % of GDP. There is an urgent need to reduce these for many reasons.

The tax administration model operates with outdated departmental manuals, and outmoded information technology (IT) platform which rely on the pirated systems and softwares. Advance countries are using business intelligence (BI) and artificial intelligence (AI) tax solution technologies for compliance and reducing human interaction in tax filing and tax analysis.

The tax administration model operates with outdated departmental manuals, and outmoded information technology (IT) platform which rely on the pirated systems and softwares. Advance countries are using business intelligence (BI) and artificial intelligence (AI) tax solution technologies for compliance and reducing human interaction in tax filing and tax analysis.

Making Policy Pro-Growth is the Way Forward

The policy should facilitate transactions to help grow the economy. Hence, it should be simple, efficient, and convenient, and help create a conducive environment for economy to grow. Some reforms that have been recommended in this regard are as follows:

- The tax reforms call for broad based, low rate simple taxes[9]. It is suggested that there should be a simple and predictable income tax regime. Those withholding taxes that contribute only meagerly but have higher cost of collection (compliance cost) should be abolished. Moreover, the average tax burden should be lessened by decreasing the compliance cost through reduction in documentation requirements. This would a better approach to encourage entrepreneurship and get sustainable revenues than some crude documentation drive.

- GST harmonization should be the priority. Several options are available to opt from.

(a) The first best solution requires a constitutional change to address this issue.

(b) The second-best option could be agreements for collection and enforcement and harmonization between provinces. The provinces can maintain the tax powers to change some elements of the tax bases (e.g. rates between certain limits).

(c) Third option can be to harmonize the international tax bases and those elements of the sales tax that may affect the allocation of the tax. The sales tax rates of any activity taxed on origin basis should be equal in all provinces.

Where the sales tax applies on destination base, it is not necessary to have a full harmonization of the rate, but it is necessary to establish limits to avoid spillovers when cities of different jurisdictions are close.

3. As per the NFC awards the federation is responsible to provide revenues to the provinces irrespective of their contribution in the total tax revenue collection. The provinces contributed only 8 % of the total tax revenues in the second half of 2019.[10] This further strains the fiscal space of the federation. It was suggested that provinces should have the exclusive right to levy indirect taxes on goods and services within their respective physical boundaries. The federal government should have the exclusive right to levy tax on all kinds of income, including agricultural income. A serious debate on this issue is still required.

4. Existing tax system is four-tier appeal system which is hopelessly redundant, painfully unproductive and marred with inefficiency and inordinate delays. There is a need of complete restructuring in tax justice system so that fiscal disputes between the state and taxpayers get settled within a year at most. The existing Inland Revenue and Customs Tribunals should be merged and renamed as National Tax Court. If National Tax Court is established, there will be a drastic reduction in litigation[11].

________________________

[9] Bukhari, Huzaima & Haq, Ikramul. (2016). Towards Flat, Low-rate, Broad and Predictable Taxes, Islamabad: PRIME Institute

[10] Ministry of Finance, Fiscal Operations, July to December 2019-20.

[11] Bukhari, Huzaima. Need for National Tax Court, Pakistan Enigma of Taxation, published by LAP LAMBERT Academic Publishing (December 30, 2011)

5. The culture of SROs is unconsti-tutional and hence should be completely abolished. The 2013 ruling of the Supreme Court of Pakistan states that “Parliament/Legislature alone and not the Government/ Executive are empowered to levy tax”. The sectors supporting education and health can be exempted.

6. The SRO’s were ruled out in 2013 by law but they were “tariffied” or transformed into tariffs under Fifth Schedule. The Fifth Schedule has exemptions/concessions for import of plant and machinery, and inputs of pharma sector, poultry & dairy sectors, home appliance sector, textile sector, imports under Auto & Aviation policies etc. To become an active player in the global value chain, Pakistan should minimize the loops in the form of concessions & exemptions regime. SROs also maintain a distinction between commercial importers and local manufacturers.

7. Unlike other countries, the tariff instrument has been used here for revenue generation rather than growth and industrialization. This short sightedness of the policy raises conflict of interests as tax collecting authority would always prefer high tax rates. There is a dire need for the tariff policy to be designed around “facilitation of transactions” or “growth”. The rationalization of tariffs should be a phased process.

(a) First phase – revise duty tariffs with more reliance on domestic taxes.

(b) Second phase – clear sectoral policies should be developed and tariffs be aligned with those sectoral policies. The exemptions should be merit-based only.

(c) Third Phase – once the tariff policy is in place, all the exemption schemes to be phased out.

| BOX 8: Conference Agenda Doing Taxes Better: Shifting the Paradigm of Tax Policy and Administration March 11, 2020, Planning Commission Auditorium INTRODUCTION: SETTING THE ISSUES Presenter: Dr. Nadeem Ul Haque, Vice Chancellor, PIDE SESSION I: WHY CANNOT WE FIX OUR TAX POLICY? Session Chair: Dr. Nadeem Ul Haque, Vice Chancellor, PIDE Panelists Mr. Shahid Hafiz Kardar (Ex-Governor, SBP, and Vice Chancellor, BNU) Dr. Ikramul Haq (International Tax Counsel) Dr. Athar Maqsood (Professor, NUST) Dr. Hamid Atiq Sarwar (Member Policy, FBR) SESSION II: TARIFFS: OPENING OUT FOR COMPETITIVENESS Panel Chair: Dr. Manzoor Ahmad (Ex-Ambassador, WTO, and Senior Fellow, PIDE) Panelists: Dr. Manzoor Ahmad (Ex-Ambassador, WTO, and Senior Fellow, PIDE) Ms. Teresa Daban Sanchez (Resident Representative, IMF Pakistan) Dr. Jawwad Uwais Agha (Ex-Member Customs, FBR) Mr. Jamil Nasir (Collector of Customs, FBR) SESSION III: TECHNOLOGY, ADMINISTRATION AND DOCUMENTATION FOR GROWTH Session Chair: Mr. Shahid Hafiz Kardar (Ex-Governor, SBP, and Vice Chancellor, BNU) Panelists: Dr. Ikramul Haq (International Tax Counsel) Dr. Jawwad Uwais Agha (Ex-Member Customs, FBR) Dr. Muhammad Ashfaq Ahmad (DG International Taxes, FBR) Ms. Clelia Rontoyanni (Lead Public Sector Specialist, World Bank Pakistan) SESSION IV: CONCLUDING REMARKS AND TAKEAWAYS |

8. The electronic declarations and documents submission, digital signature communications, and web-based Tracking & Audit Trails (TAT) are the necessary reforms that can serve the purpose of enhancing the efficiency of the tax administration.

9. The digitization of tax system and one-window environment would lower the business cost. It must be online with imaging and digital signatures. The minimal human interaction would lead to a transparent system and maintain an efficient economic environment. In this regard, instead of having a number of agencies for documentation, one-window operation can increase the efficiency of the tax administration. For working in an integrated environment, digitization and data driven system is inevitable.

10. There is a need for reforms in regulatory framework on data sharing of public and private sector agencies with FBR. The availability and sharing of data could increase compliance by covering variety of sources of income before filling of tax returns. For instance, banks maintain registry of each customer and transaction. State Bank records this data. Government should sit together with public and-private agencies to formulate a plan to configure this data with FBR. The data sharing between institutions would also provide a mechanism to bring in non-filers into the system, thereby paving the way to ending the distinction between filers and non-filers.