Hotel and Restaurant Industries of Pakistan: Opportunities and Market Dynamics

Abstract

The tourism and hospitality industry has been rising in significance in Pakistan over the past few years, contributing 5.9% to national GDP and generating 3.8 million jobs in the year 2019. In terms of growth rates, this industry expanded by 3.5% in the same year, compared to the 2.5% expansion of the Pakistani economy as a whole.

Considering the general growth of the tourism and hospitality industry of Pakistan, the Pakistan Institute of Development Economics carried out a series of focus group discussions and collected data via questionnaires with key stakeholders in the restaurant and tourism sectors – two of the primary contributors to the hospitality and tourism industry – to ascertain salient bottlenecks in these markets and how they can be corrected.

1.Introduction and Overview

The tourism and hospitality industry constitutes a significant portion of global trade and investment. In 2019, it made up 10.4% of global GDP and supported 334 million jobs – amounting to approximately 1/10 of the international workforce.

During the 2014-2019 period, the industry was responsible for a whopping ¼ of all new jobs created – indicating a thriving demand for the service around the world. In terms of tourist expenditures, the majority – i.e. 71.7% – go to domestic services, signifying a general preference for local options.

In the Asia-Pacific region, of which Pakistan is a part, the GDP arising from tourism and hospitality stood at USD 3.061 trillion in the year 2019 – and generated approximately 185.1 million jobs. It was the highest performing region in terms of annual growth of the industry worldwide.

In the subsequent year, the tourism and hospitality industry took a significant hit around the world – leading to the loss of 62 million jobs, an aggregate decline of 18.5%. The brunt of the impact was absorbed by the SME sector, which constituted 80% of enterprises in the industry.

The figure illustrates the impact of COVID-19 on the tourism and hospitality industry in Pakistan, with expenditure from domestic sources in particular taking the biggest hit – going from Rs. 1.65 trillion in 2019 to Rs. 1.16 trillion in 2020, a decline of 29.4 percent.

Employment and contribution to GDP also fell, with the former declining 11.1 percent in terms of jobs and the latter declining a whopping 23.1 percent in terms of proportion of national income.

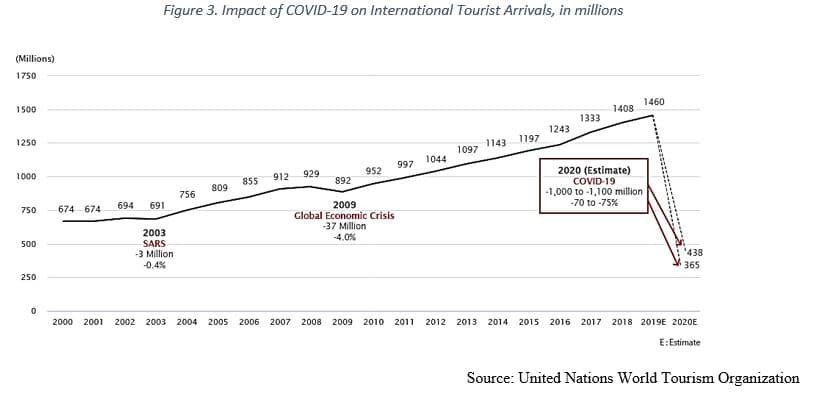

The figure above illustrates the impact of COVID-19 on the tourism and hospitality industry worldwide, with international flights linked to tourism purposes dropping from 1.4 billion in 2019 to approximately 400 million in 2020 – a decline of almost 30 percent. This indicates a lack of preparedness on the part of the business operating in the sector, as well as national governments and international institutions that could have potentially led a comprehensive coordination campaign to preserve trade in the area as much as possible. Without adequate preparatory measures, even the recovery from the pandemic has been sluggish – although rising with time.

2. Overview: Hotel and Restaurant Industries

Pakistan’s tourism and hotel industry was valued at nearly $20 billion in 2020. However, due to the recent pandemic, the tourism and hotel industry has been severely affected. The tourism sector was contributing 7.1% to the Gross Domestic Product. Hotel and restaurant industry of Pakistan has been emerging due to the importance of tourism industry interlinked with hotel industry of Pakistan. (Sajjad, 2018) ; shows the sustainability practices adopted by the hotel industry of Pakistan. The major companies in the world are ensuring sustainability practices in their business operations and developed countries are also witnessing such practices as compared to developing countries. It is inferred that the sustainability not really integrated into the business operations of the major hotels of Pakistan.

The training programs for the human resource are also some of the important things in the services sector. Its main aim is to improve the skills, performance and abilities of the employees to cater the demands of the customers in an efficient manner. Due to the competitive market, the customer demands has been increased drastically, which can only be fulfilled through effective training of the employees in the hotel industry (Nawaz Khattak, Rehman, & Abdul Rehman, 2014). It is important to note that customers’ experience has been considered the determining factor in the continuation of the business operations of that hotel, directly linked to human resource quality. (Naseeb Ullah Shah, Jan, & Bakhsh Baloch, 2018)

In a study conducted in 2012, it was demonstrated that the factors responsible for the declining performance of the hotel industry of Pakistan are: political instability, marketing incompetence, lack of proper infrastructure and security issues. (Khan, 2012)

Stress is also a major determinant of behavioral outcomes in the hotel industry. (Nawaz & Sandhu, 2018) It was showed that stress affects the job satisfaction and employee turnover rates in particular. The study suggests that the problems of employees can be dealt with financial bonuses and encouragement through appreciation of the employees.

In modern times, the restaurant industry plays an important role in arranging catering and other professional services for the customers. There is not much data available for the catering restaurant business in Pakistan. Various factors such as rapid urbanization, new food cuisines, female participation and American culture have played a role in reviving the restaurant industry of Pakistan. (Shaikh and Khan, 2011)

The food industry ultimately depends upon customer satisfaction. In this competitive world, the restaurant and food industry strive to offer the best services to their customers so that they can stay afloat in a cutthroat market. Therefore, quality service delivery is (or ought to be) top priority in order to encourage brand loyalty and leverage word-of-mouth as a marketing strategy – as evidenced in a 2017 study emphasizing the strong correlation between service quality and customer satisfaction. ( Rana, Lodhi, Butt, & Dar, 2017)

In a 2019 study, it was demonstrated that excellent service delivery prompts customers to return in the future. Furthermore, the loyalty of the customer largely depends upon the service delivery irrespective of the money being spent – meaning that price elasticity of demand decreases in importance as quality of service rises. Another important factor for customer retention is the location of the restaurant. It is suggested that the strategic success of the restaurant is dependent upon its location. (Ahmed, Shaikh, Naseer, & Muhammad Asadullah, 2019) :

There are various factors that influence the customer choices to choose a specific restaurant. A 2014 study showed that the menu, promotional deals and service quality are the determining factors for the customer choice about the selection of the restaurants. However, the restaurant interior design and decoration also plays role but the paramount role is of the service delivery and quality. (Azim et. al, 2014)

3. Market Dynamics of the Hotel Industry

During PIDE’s conversations with key informants during the course of this research project, the following salient points were uncovered.

3.1 Opportunities

Firstly, that the competitive dynamics of Pakistan’s hotel industry are such that monopolistic tendencies have withered away over time – diluting barriers to entry and making room for new players. A sense of dynamism to the process also seems to be prevailing, with some hotels – such as Roomy – focusing their attention on taking over existing infrastructure (small-scale hotels that have defaulted) and renovating it to initiate new businesses rather than starting from scratch as their standard operating procedure for expansion. This is a net positive, as it keeps costs low while also avoiding the need to demolish buildings already in place.

An increasing number of businesses are also beginning to establish an online presence through booking applications, website availability, and social media accounts – although the general commentary around digitalization involved complaints of the high costs of maintenance, particularly in remote regions where internet availability is scarce. Furthermore, it was stated that the demand for resorts, particularly in far flung areas, is rapidly rising – although a dearth of options exist for prospective customers that are not looking for luxury accommodation.

There is a need, therefore, to develop domestic tourism and make available lower tier hotels to make travel and tourism more accessible to the general public. Furthermore, a coordinated publicity campaign – involving the government – ought to be initiated, which aims primarily to revive the image of the industry: something that has been tarnished over the years by frequent incidents of terrorism, political turmoil, and the malpractices of certain businesses – such as the incident in Murree, where hotels hiked up their prices when tourists were stuck in the city following adverse weather conditions. This ‘image problem’ can be addressed via short films, documentaries, vlogging, etc. that is broadcasted to the public via television, radio, and social media.

3.2 Challenges

In terms of employment dynamics, the salient feedback from our discussants was that the skills found in university graduates are generally lackluster as far as the tourism and hospitality industries are concerned. One possible reason for this may be the fact that there is a dearth of vocational training facilities specifically geared to the hotel industry, which compels individual hotels to take on the responsibility of polishing the skills of their newly employed hires – something that the Serena Hotel, for instance, has been doing in recent years. This was achieved by working on skills development, conducting trainings specific to women, and educating farmers on growing various kinds of produce. This has led to Serena’s (and some other hotels, such as Marriott) retention rates to be comparatively higher. It is worth mentioning, however, that these independent initiatives are few and far between, and most hotels – particularly smaller ones with fewer resources at their disposal – are generally reluctant to invest in them – particularly in the northern areas, where demand is usually high. This is a crucial bottleneck to the flourishing of the industry, largely because a skilled workforce is one of its pivotal elements.

A series of bottlenecks in terms of governance were also voiced. Of these, the most significant one was a lack of basic infrastructure – i.e. roads, pavements, sanitation, energy, security, internet, etc. This forces the cost of setting up shop for hotels up, as they are compelled to make available these basic amenities – frequently from scratch. A salient example of this is the territory between Islamabad and Murree. More broadly, it is also especially pronounced in areas of Gilgit-Baltistan. Furthermore, a long laundry list of documentation and special permissions are required from hotels in order for them to operate, which render registration and business operations cumbersome and function to repel potential investors in the market. This is a general problem within Pakistan’s commercial sector, outlined in detail in PIDE’s Reform Agenda for Accelerated and Sustained Growth report. (PIDE, 2021)

These hurdles need to be overcome, through minimizing documentation requirement, digitalizing the process, as well as generating a comprehensive policy to incubate the sector by ensuring infrastructural needs are met and the introduction of incentives for businesses to expand their operations by appealing to a broader customer base. Even when it comes to corporate social responsibility, the taxes and regulations in place function to obstruct operations rather than protecting the environment – and thus need to be rethought in a manner that is more dynamic in its nature. One option could be to involve governing associations from the private sector, collections of hotels that collaborate with one another to present consolidated demands from the government as well as serving as a platform for networking, coordination, and the pooling of resources for joint initiatives. The Pakistan Hotel Association is one such organization, although its capacity and reach is generally limited as things stand.

3.3 Focus Group Discussions with Industry Experts

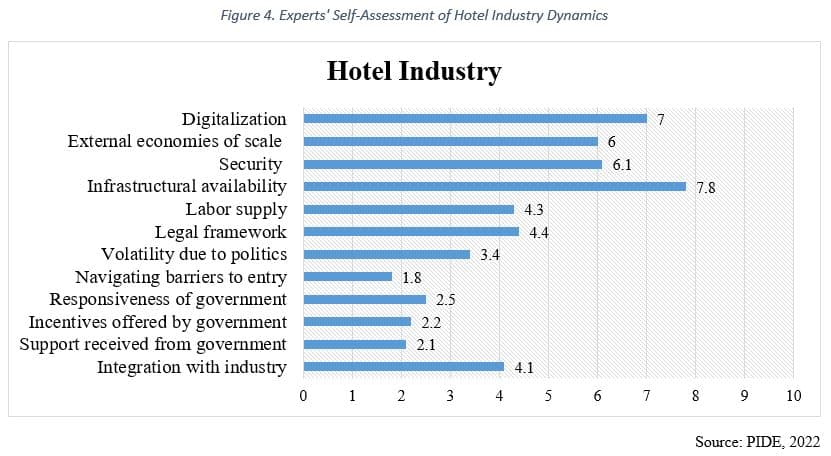

Through a series of engagements with representatives from 12 key hotels, the Pakistan Institute of Development Economics sought to ascertain their perception of various aspects of the industry – ranging from political instability and infrastructural constraints to extent of digitalization and government support/oversight. Participants in the questionnaire were asked to rate each category on a scale of 1 to 10, and average responses are depicted in Figure 2 above.

The most significant hurdle that hotels seem to be facing are barriers to entry, a lack of government support (in terms of responsiveness to queries about legal/regulatory hurdles, offering platforms for businesses to come together, and relaxing tax burdens), a lack of integration into the industry, a weak labor supply, political volatility, and a poorly thought out legal framework. Taken together, these suggest that a comprehensive, context-specific policy framework is in order for the hotel industry that is shaped by – first and foremost – owners of businesses themselves, i.e. those with the most skin in the game.

4. Market Dynamics of the Restaurant Industry

In our engagements with key informants from the restaurant industry of Pakistan, the following salient points were discovered.

4.1 Opportunities

Despite some human resource related hurdles, successful restaurants in Pakistan are able to employ thousands of workers. Savour, for instance, currently runs 10 branches across the country – with a presence in Islamabad, Rawalpindi, and Lahore – and has 1,500-2,000 employees on its pay roll. Over the next 10 years, its strategic vision is to expand further – targeting a total of 20 to 30 branches nationwide, naturally boosting employment further. Its organizational structure/culture is also worth delving into as a case study. Experts from our panel discussion claimed that a handful of experienced individuals (>25 years of experience) form the core of the organization, who handle key decision-making processes and ensure regular upgrades to the skillsets of their employees. This is achieved by either sending them to attend seminars hosted by organizations such as the Punjab Food Authority and National Incubation Center, or their in-house training center based in Lahore. Senior employees are also expected to maintain regular contact with those lower down the ladder, imparting ‘tricks of the trade’ to them in a dynamic, informal manner that constitutes on-the-job training.

With the onset of COVID-19 and the forced closures that accompanied, most restaurants were forced to downsize and transition to a revolving policy whereby a preference for short shifts generally prevailed to help keep costs low. During this period, a significant number of restaurants shifted to delivery-only, establishing working agreements with services such as Foodpanda and Cheetay to leverage the use of technology in business operations. Despite the benefits of these services, which include not only deliveries but also the monitoring and evaluation of performance – the data from which is shared with restaurants on a periodic basis to help boost efficiency – there were certain grievances as well. These were predominantly focused around the high charges of these applications: with Foodpanda charging 28% of the sales price and Cheetay charging 15% – both of which functioned to drive down demand for products. One reason for these exorbitant charges, as per our experts, could be the monopolistic nature of the food-deliveries market, with Foodpanda in particular dominating the industry by a large margin.

Some of the ways businesses have incorporated corporate social responsibility into their operations may be gauged with the example of Savour, which has actively been involved in relief efforts following natural disasters such as earthquakes, tree plantation drives to help preserve urban climate, and awareness campaigns for various causes. Our expert, a member of the core executive team, claimed that ensuring the well-being of society is one of Savour’s primary objectives – and encouraged other businesses to pursue similar initiatives as they will assist in the maturation of the larger industry.

4.2 Challenges

The competitive potential of the industry is thought by experts to have been hampered by the large investment that goes into start-ups in the space. This figure ranges from Rs. 5-10 million, and it takes a minimum of a year for a restaurant to establish a brand name for itself. This is largely due to the space, structure, and full-time employees that are required at the outset.

Attracting competent employees is also a challenge, for several reasons. The first is the generally secretive nature of the industry, whereby information about industry dynamics are not freely shared – and the employees that manage to establish a foothold with one organization generally tend to be reluctant to leave. Further, the majority of employees constitute young, inexperienced individuals that need to be trained on the job in order to bring them up to speed with the operations of the business. Similar to the hotel industry, a lack of training facilities are in large part responsible for this. A couple of exceptions to this, however, are the National Incubation Center and the Hashoo Foundation – which offers training in human resources that is specific to the restaurant industry as well as function to connect stakeholders operating within it. Private-led associations dedicated to coordination/integration are also generally missing in the industry – compelling individual restaurants to organize events and gatherings for themselves to share guidance and information.

A common grievance that business owners in the restaurant industry of Pakistan tend to have is the excessive levels of taxation that are levied on operations, currently at 17%, regardless of any other factors such as the age/size/success of the firm in question. Relaxations in tax requirements, particularly for new entrants, as well as simplified/reduced documentation requirements were both salient propositions posed by our experts. Legal hurdles were relatively better structured, and restaurant owners also pointed out the presence of government departments meant to assist with hurdles in this particular sphere – although many of them seemed inactive or took excessively long time durations to respond. PIDE’s Reform Agenda for Accelerated and Sustained Growth report has documented this extensively. (PIDE, 2021)

4.3 Focus Group Discussions with Industry Experts

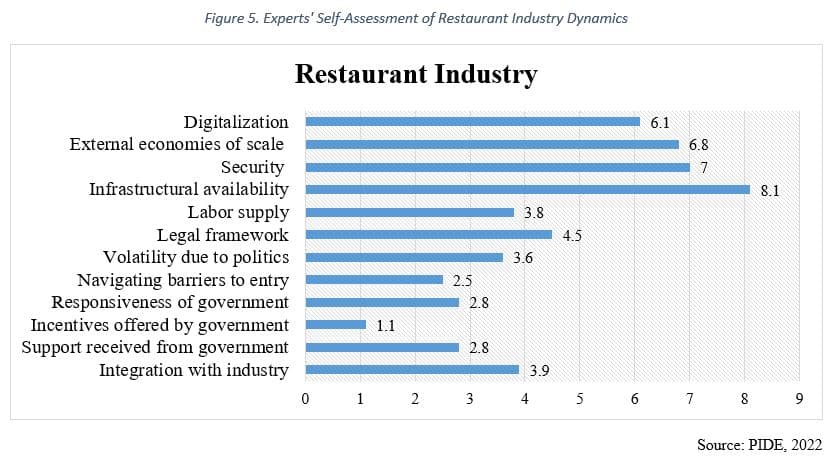

Through a series of engagements with representatives from 12 key restaurants, the researchers from the Pakistan Institute of Development Economics sought to ascertain their perception of various aspects of the industry – ranging from political instability and infrastructural constraints to extent of digitalization and government support/oversight. Participants in the questionnaire were asked to rate each category on a scale of 1 to 10, and average responses are depicted in Figure 2.

As was the case with the hotel industry, the restaurant industry’s most pressing bottlenecks were identified to be a lack of oversight/incubation from government agencies, of which the most salient were incentives, along with political uncertainty and a labor supply that lacked adequate skills to perform tasks specific to the requirements of enterprises in the sector. According to our experts, barriers to entry into the industry predominantly came in the form of long lists of requirements that prospective firms were required to fulfil, such as paperwork and other background checks, before being allowed to operate.

5. Conclusion

In sum, the hotel and restaurant industries of Pakistan seem to be in their incubation phase – with significant room for improvement, particularly if the country wishes to keep up with global trends.

| Way forward for Hotel and Restaurant Industries: · Establish umbrella organizations to bring businesses together and coordinate joint-ventures, including events and conferences · Encourage digitalization by establishing internet infrastructure freely accessible to all and offering tax breaks to businesses that move in this direction via the establishment of websites and mobile applications to streamline booking procedures · Improve infrastructure – including roads, pavements, sanitation, energy, security, etc. · Include local communities in the development process, ensuring their needs are not compromised via pollution, harm to wildlife, and economic extraction · Work with higher education institutions to establish short vocational courses specifically tailored to the demands of the tourism and hospitality sectors · Simplify legal and administrative hurdles in order to incentivize investment by reducing barriers to entry · Establish safe conditions at a political level and curb economic/social instability by adopting inclusive development practices that do not alienate groups |

References

Ahmed, A., Shaikh, S. S., & Naseer, R. (2019). Factors affecting Customer Retention in the Restaurant Industry: Moderating Role of Restaurant Location. IBT Journal of Business Studies (JBS), 2(2). AZIM, A., SHAH, N., MEHMOOD, Z., MEHMOOD, S., & BAGRAM, M. (2014). Factors Effecting the Customers Selection of Restaurants in Pakistan. International Review of Management and Business Research.

Shah, S. N. U., Jan, S., & Baloch, Q. B. (2018). Role of service quality and customer satisfaction in firm’s performance: Evidence from Pakistan hotel industry. Pakistan Journal of Commerce and Social Sciences (PJCSS), 12(1), 167-182.Nawaz Khattak, A., Rehman, S., & Abdul Rehman, C. (2014). Organizational Success through Corporate Trainings: A Case Study of Hotel Industry of Pakistan. Journal of Business Studies Quarterly.

Nawaz, A., & Sandhu, K. Y. (2018). Role stress and its outcomes: evidence from hotel industry of Pakistan. Structural Equation Modeling A Multidisciplinary Journal, 2, 49-60. Rana, M., Lodhi, R., Butt, G., & Dar, W. (2017). How Determinants of Customer Satisfaction are Affecting the Brand Image and Behavioral Intention in Fast Food Industry of Pakistan? Journal of Tourism & Hospitality.

Sajjad, Aymen, Aleena Jillani, and Muhammad Mustafa Raziq. “Sustainability in the Pakistani hotel industry: an empirical study.” Corporate Governance: International Journal of Business in Society 18, no. 4 (2018): 714-727. SHAIKH , U., & KHAN, N. (2011). IMPACT OF SERVICE QUALITY ON CUSTOMER SATISFACTION: EVIDENCES FROM THE RESTAURANT INDUSTRY IN PAKISTAN .

Khan, M. K. (2012, December 17). Challenges Affecting the Tourism Industry in Pakistan. Theseus.

United Nations World Tourism Organization. (2022, February 6). International Tourism and COVID-19.