LSM – Pakistan Steel Industry Outlook

LSM – Pakistan Steel Industry Outlook

The steel industry delivers essential inputs for the country’s industrial economic growth and development. Steel’s importance in other sectors, such as construction, transportation, machinery, metal products, energy & electrical equipment, and domestic appliances, cannot be overstated.

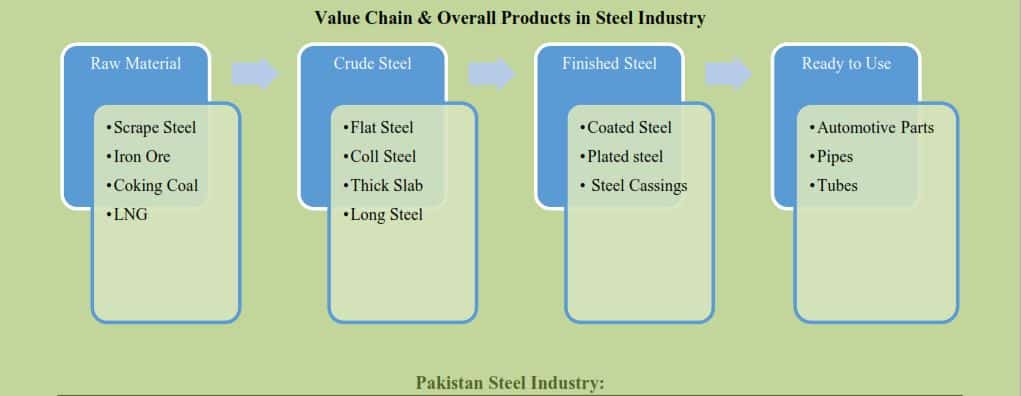

Steel comprises two main components: (1) iron ore and (2) recyclable steel. The steel industry is factor intensive; the production of iron and steel requires large factories, iron ore, energy, and labour. The high cost and low return make it difficult for new investors to enter the market.

DEVELOPMENT AND OVERVIEW OF THE STEEL INDUSTRY IN PAKISTAN

The importance of the steel industry cannot be ignored in the economic development of Pakistan through construction projects, infrastructure building, and industrial development.

Proposal of Steel Mill

The Development of the steel industry was first proposed in the first five years (1955 to 1960) plan.

Establishment of Karachi Steel Mill

Steel mill was established in 1968, and the government decided to sponsor a state-owned Karachi steel mill. It was separate corporation according to the Act of 1913.

Pakistan Steel Industry

In 1973, Mr. Zulfiqar Ali Bhutto laid the foundation of the Pakistan steel industry.

Role of Soviet Union

In January 1971, the Soviet Union signed a letter and ensured to deliver technology and financial assistance for the construction of the steel mill. The construction activities of the integrated steel industry began under the direction of Soviet experts.

The Price Control and Prevention of Profiteering and Hoarding Act, 1977 was introduced, and the Office of the Controller General of Prices (CGP) was established in the Ministry of Industries[1].

The steel mill included over twenty components, each of which was made up of a large unit that had been commissioned in its own right. All of the work was completed between April 1981 and August 1985.

Entry in the Club of Steel and Iron

The commission of the Blast and Furnace in August 1981 represented Pakistan’s admission into the club of steel and iron producing economies. This project had a capital cost of 24700 million dollars.

Steel Mill

In 1985, the steel mill was formally inaugurated by General Zia-ul-Haq.

Production Capacity

Over time, several private investments lead to the installation of new steel production units.

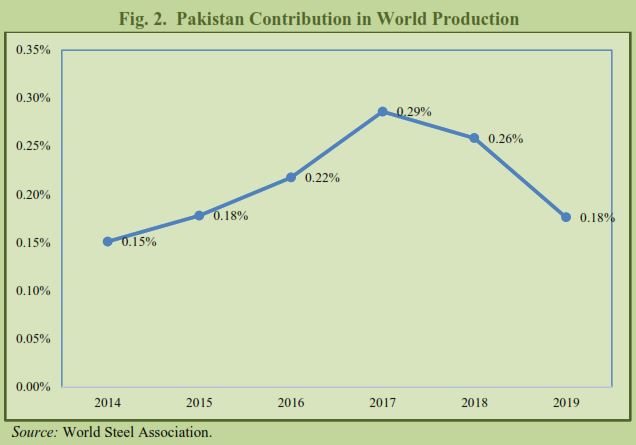

Now the steel industry is a big production unit with 600 smaller and bigger mills and a production capacity of 3.3 million tons in 2019[2], which is 0.18 percent of the world production [World steel association report 2020].

Major Players

Pakistan steel has 20 major players in the organised sector; Amreli, Agha, Mughal, Frontier Foundry Steel, Razaque, Bilal, and Aitamad Steels are well known with sizable market share.

They make up 80 percent of the total market.

Combined revenue of PKR 150bln was generated by these entities in FY 2020 (Steel Sector an Overview 2020, PACRA).

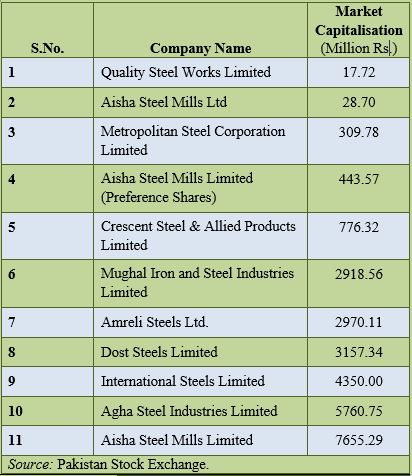

Companies Listed on PSX

The industry has 11 entities listed on the PSX having a significant contribution to local steel production capacity.

______________________________

The author is grateful to Dr Nadeem Ul Haque, Vice Chancellor, PIDE for ideas/comments on the earlier draft of this brief.

[1]According to the Act, the government was allowed to fix maximum prices of essential products. This system acted as an impediment in the way of investment, but at present that office has been closed.

CURRENT WORLDWIDE STANDING

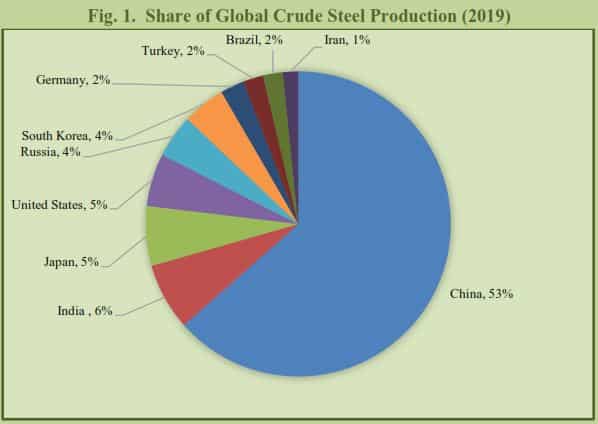

World steel production has increased significantly from 1,149 million tons in 2005 to 1,625 million tons in 2015, and currently, it is 1875 million tons. According to World Steel Association the top 10 steel-producing countries in 2019 are China, India, Japan, the United States, Russia, South Korea, Germany, Turkey, Brazil, and Iran. Whereas Pakistan produces 0.18 percent of the world production and stands at the 39th position out of 50 countries.

____________________________________

[2]This includes: raw products (iron ore and scrap); flat products (sheets and plates, used in the automotive sector); and long products (steel bars, wire rods, rails and structures used in infrastructure development and tubes and pipes).

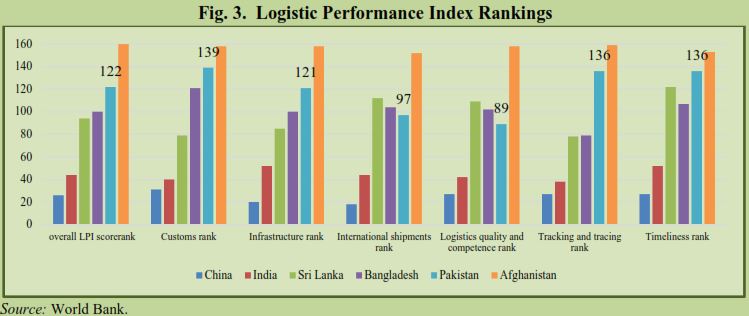

The World Bank designed the Logistics Performance Index (LPI)[3] as an interactive benchmarking tool to help nations identify the issues and opportunities they face in trade logistics and what they can do to improve their performance. In 2018, Pakistan was ranked at 122 among 160 countries on the aggregated Logistic Performance Index (LPI), trailing behind many Asian countries due to lack of spending on infrastructure projects, including airports and highways. India is at 44th position (top performer in the region) while Bangladesh and Sri Lanka stand at 100th and 94th place in the list.

_______________________________

[3]The Logistics Performance Index is a benchmarking tool to help countries identify the challenges they face in their performance on trade logistics and what they can do to improve their performance. It is the weighted average of the country scores on six key dimensions: customs performance, infrastructure quality, ease of arranging shipments, logistics services quality, consignments tracking and tracing and timeliness of shipments. As we are focusing on steel industry in Pakistan, steel is heavily used in construction, transport, machinery, metal equipment etc. Import and Export of steel is also a concern so analysing LPI is relevant.

PAKISTAN STEEL PRODUCTION, IMPORTS, AND EXPORTS

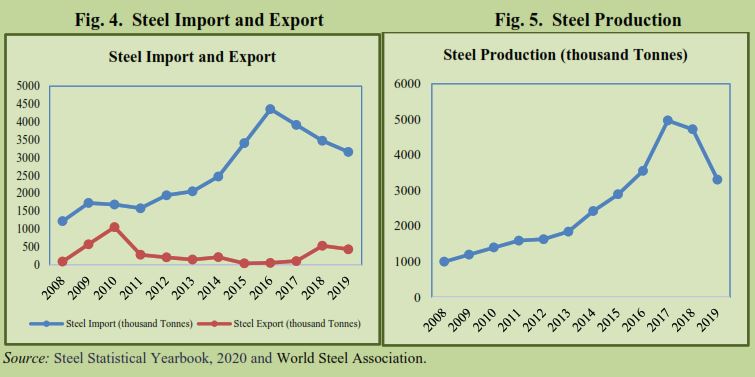

Figure 4 depicts the trend in crude steel production in Pakistan from 2008 to 2019, whereas Figure 5 depicts the import and export trends of completed and semi-finished steel products.

The domestic production and import of steel have expanded significantly due to an increase in domestic demand. The main reason behind the rise in steel production from 2008 to 2018 was an increasing demand for steel commodities in transportation, defense, automotive, and appliances sectors, industrialisation and expansions, increase in housing projects and infrastructure projects under CPEC (The State of Pakistan’s Economy, Annual Report 2018).

However, the production and imports of steel declined from 2017 to onward, due to a slowdown in housing demand, and contraction in the automobile industry. Production of long steel products, used mainly in construction sector activities, also dipped sharply. Moreover, the contraction in the automobile sector adversely affected flat steel producers throughout the year, as demand remained low (The State of Pakistan’s Economy, Annual Report 2018 and 2020).

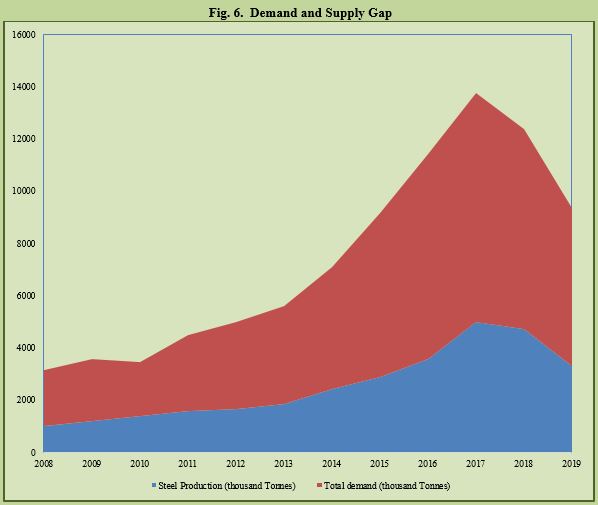

Over the last five years, the average domestic demand for steel and ironhas been 7.3 million tons per year, and domestic production only covers 3.8 million tons (see Figure 6). To meet this demand-supply gap, Pakistan has been importing from different countries and incurring too much cost on steel imports. Higher imports also indicate that the industry lagged behind the desired progress and could not fulfil the market need. Therefore, it is necessary to figure out the causes for understanding the under-utilisation of the steel industry.

Over the last five years, the average domestic demand for steel and ironhas been 7.3 million tons per year, and domestic production only covers 3.8 million tons (see Figure 6). To meet this demand-supply gap, Pakistan has been importing from different countries and incurring too much cost on steel imports. Higher imports also indicate that the industry lagged behind the desired progress and could not fulfil the market need. Therefore, it is necessary to figure out the causes for understanding the under-utilisation of the steel industry.

REGULATION OF THE PAKISTAN STEEL INDUSTRY

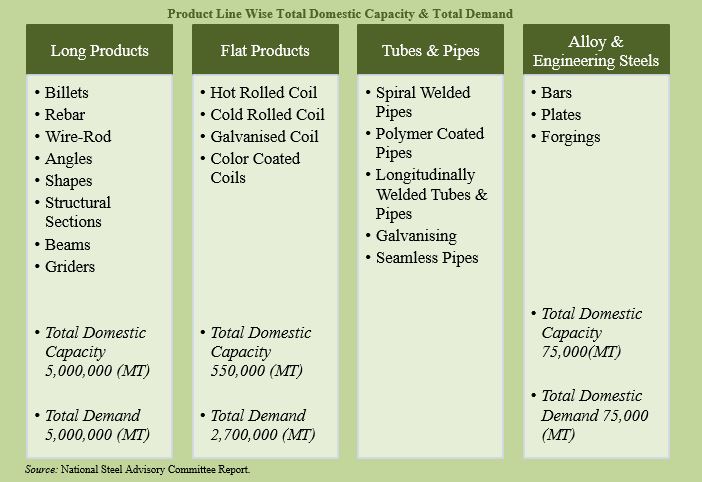

Currently, there exist various regulatory bodies to regulate the steel industry, including the Ministry of Industries & Production, National Steel Advisory Council (NSAC)[4], World Steel Association, Pakistan steel mills corporation, Pakistan Industrial development cooperation, Pakistan Association of Large Steel Producers (PALSP), Pakistan Standards and Quality control (PSQC), Pakistan Steel Melter Association, and Steelbis. Similarly, relevant laws regarding substandard steel products and their raw material are also in place. Moreover, Pakistan Credit Rating Agency (PACRA) and Credit Rating Companies Regulation, 2016 are also in the picture. Its broad support is in achieving licensing requirements, addressing restrictions, duties, and obligations of credit rating companies, accounting, and maintaining financial records.

Government interventions have taken three forms in the manufacturing steel industry setup: Price, investment and import controls; protection against imports, export subsidies, and fiscal incentives; and direct government intervention. The government has been encouraging the manufacturing sector through import policy, tariffs, and subsidies. High effective protection rates, levying export duties on inputs used in various industries, fiscal incentives (tax holidays, tax credits, accelerated depreciation allowances, an export subsidy, and preferential export financing) resulted in sharp growth of the industries. Over the decade imports have been liberalised, tariffs have been rationalised, and the system to provide favours to the industries and firms through SROs has been discontinued. In the past, some associated regulatory bodies existed, but due to the lack of a formal national steel policy, there was a lack of a modern, efficient industrial base (Kemal, 2002).

____________________________________

[4] NSAC has recommended steel industry should have a separate policy which is not formulated till date.

CHALLENGES AND ISSUES OF THE STEEL INDUSTRY

Stakeholders[5] shared the following shortcomings:

(1) The steel industry’s capacity was sufficient to meet local demand. Many mills were only operating at 40-60 percent capacity because imported products were being dumped in the market before applying regulatory duty on steel goods. As the country has enough capacity, the regulatory responsibility will encourage an investmentfriendly environment.

(2) The Pakistan steel industry is unable to operate at full capacity due to several issues, including the rising cost of utilities, gas shortages, power outages, financial difficulties, and a lack of raw materials. The Pakistan steel factory is in this predicament due to corruption, government inefficiencies, political interference, production losses, bureaucratic management, and over employment.

(3) Time to time, energy shortages have an impact on the operational efficiency of Steel mills. Due to a lack of electricity, the manufacturing process is also not smooth.

(4) Higher interest rate and the existing law and order situation in Pakistan is the major impediment to investments in the steel business.

(5) The government should lower the GST on steel products to boost domestic steel production.

(6) The Pakistan steel industry lacks R&D initiatives to take advantage of new technology and unexplored innovation opportunities and to ensure full capacity production. This R&D provides fresh insights into processing steel production at a cheap cost and about international standards.

(7) Over-staffing is a significant problem in Pakistani steel mills, which reduces employee productivity. Besides that, a slowdown in economic activity also worsens the situation.

(8) Bureaucratic management is also one of the significant variables affecting employee attitudes about their jobs.

(9) Currently, the Pakistan steel mill is using outdated plants which need to be upgraded or replaced.

(10) The steel industry is very capital intensive. As millions of dollars are being spent on capacity building and replacing old plants, the industry needs to ensure their profitability by removing impediments (multiple taxes, energy shortages).

(11) Imported raw materials from Australia and Canada travel a long distance and incur high freight costs, raising the overall cost of production. Some Chinese completed goods are less expensive than the raw materials used to make similar things in Pakistan.

(12) Increasing trend of importing semi-finished auto components badly impacts the capacity utilisation of the steel industry. In addition to this, there is no implementation of cascading principles on imports of finished and semifinished components.

(13) Concessionary SRO’s are sometimes applied for specific projects at the time of import. Sometimes underinvoicing of steel products and importing substandard products are risky.

(14) The global trend of rising raw material prices, combined with the depreciation of rupee, has put pressure on profit margins.

(15) Small plants characterised Pakistan’s steel industry, with the majority of them employing outdated technology. Most melting, re-rolling, and fabricating firms, in particular, have small factories compared to their competitors in steel-exporting countries. Similarly, the usage of obsolete (and energy inefficient) technology raises the cost of production for these businesses, resulting in low-quality output with varied standards.

CONCLUSION & RECOMMENDATIONS

The steel industry’s importance cannot be neglected due to its importance in the economy largely in construction projects, infrastructure building, and industrial development. Pakistan steel has 20 major players in the organised sector, making up 80 percent of the total market share. Despite having a significant contribution to local steel production capacity, the industry still lags behind the desired progress. Pakistan’s steel industry is not developed on a modern efficient industrial base and has not reached the level to compete internationally. With time it has encountered political setbacks, the rising cost of utilities and shortage of utilities, import impediments, the lack of policy adoption and regulatory structure. There is no formal policy structure in spite of the recommendation of the National Steel Advisory Council. The current government recently gave incentives to the construction sector, and as a result of the housing and CPEC projects’ increased demand, new steel plants are expected to be built.

Consequently, there will be more job opportunities, and the government will be able to collect more taxes. Therefore, it is necessary to address the existing shortcomings to enhance the local production capacity and boost productivity. To provide the steel industry a timely support, formal policy formulation is recommended along with energy & technological boost, low GST, and low-interest rate.

____________________________

[5]Steel mills owners, members of regulatory bodies.

REFERENCES

Kemal, A. R. (2002). Regulatory framework in Pakistan. The Pakistan Development Review, 41(4), 319–322.

National Steel Advisory Council Report (2019). National steel policy. Prepared policy report by NSAC to present at different levels.

Pakistan Stock Exchange (formerly known as Karachi Stock Exchange). Available online: http://www. ksestocks.com/Listed Companies/SortByName (accessed on 3 August 2021)

The State of Pakistan’s Economy 2017–2018. Annual Report. State Bank of Pakistan. Karachi, Pakistan, 2018.

The State of Pakistan’s Economy 2019–2020. Annual Report. State Bank of Pakistan. Karachi, Pakistan, 2020.

Steel sector yearbook, 2020

World Bank, WDI data set.

World Steel Association.