Sucking Pakistan into a Whirlpool of Rising Interest Rates

While inflation has become a major topic for debate in today’s world politics, it is actually a tale as old as time. The world’s first recorded hyperinflation came during the French Revolution. During the 20th century, seventeen cases of hyperinflation occurred in Eastern Europe and Central Asia, including 5 in Latin America, 4 in Western Europe, 1 in Southeast Asia and one in Africa. The US came close twice – during the Revolutionary War and Civil War – when the government printed currency in order to pay for its war efforts. As it turns out throughout history hyperinflation usually coincided with wars, natural disasters and a series of ill-advised fiscal and monetary policy decisions but at the core was a result of a rapid increase in the money supply that is not supported by growth in the economy.

Inflation can either be cost push (when prices rise because production costs increase, such as raw materials and wages) or demand pull (caused by strong consumer demand for a product or service). Another form of inflation is defined as built-in inflation which occurs when enough people expect inflation to continue in the future. Because of these shared expectations, workers may start to demand higher wages in order to anticipate rising prices and maintain their standard of living. Increased wages would result in higher costs for businesses, which may pass them on to consumers. Higher wages also increase consumers’ disposable income, increasing the demand for goods that can push prices even higher. A wage-price spiral can then be set in place as one factor feeds back into the other and vice-versa.

Today, inflation around the world is being driven by high consumer demand and low supply in the economy. After the pandemic restrictions loosened up, the demand for goods skyrocketed while the supply couldn’t keep up pace, and the war in Ukraine caused further interruptions to the supply chain and increases in the prices of oil and food.

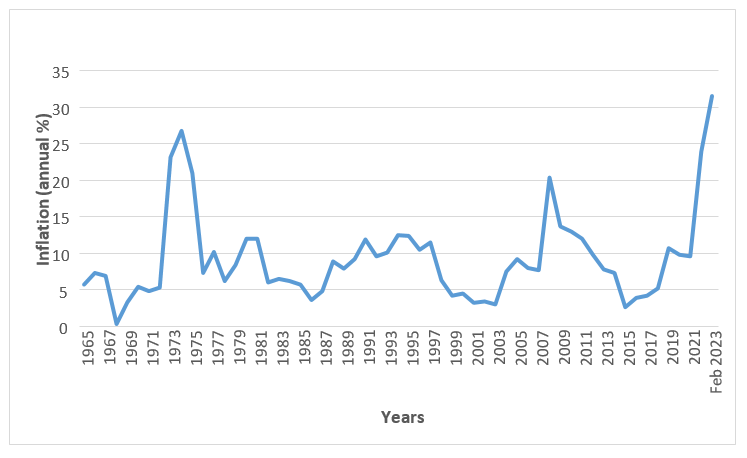

According to PBS, Pakistan’s consumer price inflation jumped to 31.5% in February of 2023, the highest rate since June of 1974, following a sharp depreciation in the rupee and as the government announced a rise in energy prices and taxes to meet the International Monetary Fund’s loan conditions. At the same time, the consequences of last year’s devastating floods have exacerbated economic difficulties. The Food and Agricultural Organization (FAO), in its recent Food Security Update, attributes the high prices to generally stagnant production since 2018, stock losses and disrupted trade flows due to the 2022 floods, high agricultural input and transportation costs, and high headline inflation. Inflation in the developing world is mainly linked to import dependence. As the dollar goes up imports become more expensive. As exports rely on imports, exports don’t become competitive despite the rupee’s decline which leads to more devaluation and more inflation. With the high inflation, the State Bank must push up the discount rate to restrict the supply of money which slows down the economy. The cost of working capital for exporters increase and finances are not available for exporters due to increased interest rates, thus failing to boost exports.

Figure 1. Inflation, Consumer Price (annual %)

Source: World Bank

The State Bank of Pakistan is raising interest rates to make lending and investing more expensive through its monetary policy in order to imprison the inflation genie back in the bottle. However, this text book solution might not work well for an economy like Pakistan. Raised interest rates can easily impact the labour market, causing unemployment levels to rise. Inflation in Pakistan is cost push and most important components of our Consumer Price Index (CPI) are Food, Housing, Water, Electricity, Gas & Other Fuels, Clothing & Footwear, and Restaurants & Hotels. All of these remain unaffected by changes in interest rates. Higher interest rates are unable to do anything about supply chain issues (such as shortage of wheat or ghee which may give rise to food inflation or shortage of cotton) that cause inflation to rise. The cost of food, housing and clothing and foot wear will continue to increase irrespective of interest rates and consumers’ basket will continue to become more expensive with standards of living continuing to decline.

At the same time the government is using fiscal policy to fix inflation by increasing taxes or cutting spending. Principally, increasing taxes leads to decreased individual demand and a reduction in the supply of money in the economy. However, taxing electricity, gas and fuel increases the cost of manufacturing for the industrial sector making our producers uncompetitive. Instead of fostering and nourishing healthy business and entrepreneurial practices the policies at present are stifling the economy. This burden of the increased cost is then transferred to the consumer through higher prices which further increases inflation. The increased taxes on energy are not only increasing household energy bills but also aggravating the situation by further increasing the cost of final goods and services, thus overall increasing the cost of consumer’s basket and decreasing the purchasing power of individuals.

Perhaps the most devastating fact remains that the rationale behind increasing taxes and interest rates is to decrease demand however no matter how much the taxes are raised the aggregate demand of the country continues to increase because of the increase in general population. As our population continues to grow it is putting immense pressure on whatever is left of the dwindling resources of Pakistan. The demand for petroleum in Pakistan is price inelastic: increasing interest rates has no effect on its demand and consequently the economy continues in a downward spiral and inflation keeps increasing.

As the stock market awaits the finalisation of the IMF bailout package, only to be disappointed over and over again, the economic crisis in the country is constantly intensifying. With increasing political instability and declining reserves the country is on the brink of bankruptcy. While the ban on imports persists, consignments of raw materials stuck at ports await the release of USD 1.2 billion tranche from the IMF.

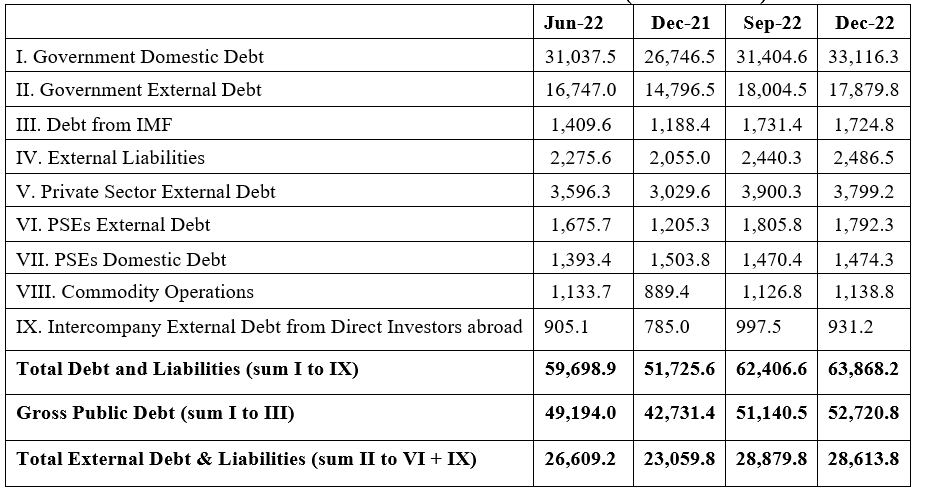

When the government increases the interest rates, the government – which itself is the lender of last resorts – becomes a borrower. Pakistan’s government debt jumped by PKR 4 trillion or around 7.7% in January 2023 to reach close to PKR 55 trillion. Meanwhile, domestic debt rose to PKR 34.3 trillion by January end. The high interest rates only serve to raise the country’s own costs. In order to finance this debt, the government has to continue increasing taxes and the economy shrinks further. According to Moody’s Analytics, inflation in Pakistan could average 33% in the first half of 2023 and a bailout from the IMF is unlikely to put the economy back on track.

PAKISTAN’S DEBT AND LAIBILITIES – SUMMARY (in Billion PKR)

Source: State Bank of Pakistan

The policy instruments used by the government are just not working and while the interest rates and taxes are increasing inflation in Pakistan continues to rise. One reason for why Pakistan is trapped in high inflation and spiralling interest rates be the structural issues in Pakistani markets. Pakistan’s economy is haunted by ineffective market mechanisms, which cause disruptions to already volatile and sensitive supply chains – in turn susceptible to environmental changes and economic and political instability. Unstable markets are prone to shortages and surpluses. The matter is worsened by inelastic demand and consumption patterns which are deeply rooted in our culture and spending habits which cannot be changed overnight.

The old belief that invisible hand of the market will ensure efficient allocation is no longer in play because there are discrepancies in our system which prevent optimal allocation and efficiency. The government cannot rely blindly on market powers to play out anymore.

Instead of the invisible hand of the market what we need is perhaps a very visible hand of the policy makers to rescue the country out of this spiral of low growth and increased inflation. Government should immediately reduce the discount rates and let the economy breathe so that it naturally breaks free of this whirlpool of inflation. A controlled intervention by the government by reducing its spending would tamp down on demand-fuelled inflation, while at the same time restoring confidence in the ability of the federal government to pay down the debt and thus control inflation expectations. Policies such as reduction in import duties of critical raw material used for production will result in stability of final price of goods and services. Government can help control inflation by reducing tariffs and nontariff barriers that push up the price of goods, ending regulations that boost shipping costs, and encouraging production of renewable energy among other means. It can reform tax laws to increase tax base. The government can take practical steps towards making supply chains and demand systems more seamless and less prone to disruptions while promoting a healthy culture of savings and investments.

The authors are affiliated with the All Pakistan Textile Mills Association (APTMA).