By Dr. Mahmood Khalid and Dr. Naseem Faraz

An Unsustainable Burden of Pensions

Prime Minister Imran Khan, while chairing a cabinet meeting on August 28th, 2020 has said that burden of pensions was fast becoming unsustainable and directed Finance Ministry to include eminent international experts in the Pay and Pension Committee to professionally evaluate the best available options[1].

Globally, pension systems generally provide income support to those persons who have either lost earnings due to old age or beeen disabled due to an incident. Each pension scheme must result in adequate resources provision to meet the basic living standards and ensure that there is less difference in pre and post retirement earnings. This would help pensioners live a decent standard life post retirement. Some argue it’s the sole responsibility of the individual via voluntary savings or the family via family contribution or the State which can create institutions as per need and sustainability.

Our Existing Pension System and Burden

The existing government pension system of Pakistan is fragmented, non-transparent, understudied, and without any underpinning asset base. Federal government, provincial governments, armed forces of Pakistan, autonomous bodies and other government agencies are throwing forward the pension liability without any plan on how to meet the growing burden.

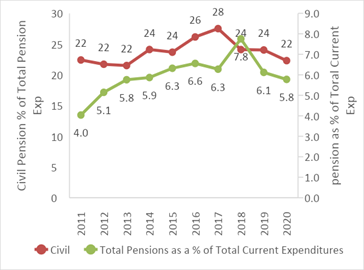

The government pension liability and the systems underpinning need a comprehensive overhaul urgently. In fiscal year 2018-19, federal superannuation and pension expenditures were almost 78% of the value for PSDP expenditures. This amount has increased to 87% in FY 2019-20. The share of pensions in current expenditures is also increasing over time (for FY 2019-20 it stood around 7.6%). However the share of Military Pensions is high and is increasing more overtime. In FY 2019-20 it was 76% and in budget estimates of 2020-21 it has further increased to 77%. However Civil pension itself is rendering into an unsustainable territory of public financial management. In FY 2019, pension rose to 40 percent of federal public expenditures on salary for civil servants due to longevity, increasing health costs and liberal reforms overtime.

Moving to a fully funded Defined Benefit (DB) or Defined Contribution (DC) system

Solutions to complex and chronic issues are not simple. According to a PIDE study on civil servant’s compensation, the existing pension system has multiple payout systems to pensioners, is actuarially unfair, has an upward bias and above all its financing is becoming expensive since it competes for taxpayers’ money. The system is a DB which requires flexibility in terms of contribution, vesting period and other parameters in case of any reform or shock such as increase in life expectancy, cost elements, inflation indexing etc. But since it is a Pay-As-You Go System, it does not consider these options. This system is unsustainable and considered to be the least preferred one globally.

This is not the first incidence either. An earlier NCGR report (Vol-I, 2008) recommended reform of pensions and this recommendation was presented as a guiding principle. The report states “the Pension System should be revised from defined benefits, to defined contribution and should be funded”. The commission proposed a complete road map which required “Complete Analysis of Pension Options” and make recommendations guided by the advice given to the government by the “Pay and Pension Committee, by the Finance Division, Establishment Division and an Actuarial firm/consultant”. This recommendation could not mature so far. We hope after the direction from PM now it will.

Global Scenario

Globally around 10-15% of the payroll is provided for financing a pension scheme. In our case, it is considered to be 33.3% of the pensionable emoluments. Switching to a fully funded DB system (inflation indexed or without index) will require an Actuarial analysis. This will determine required payroll contributions and expected payouts.

The international organizations which operate in multiple countries do not offer a large number of in-kind, and cash allowances to their staff including Pakistan. They compensate workers with very transparent and adequate pays. For example, IMF World Bank, and UNO, they offer pension plans to their employees. Both employees and organization contribute toward a pension which can be used upon retirement.

PIDE Projections

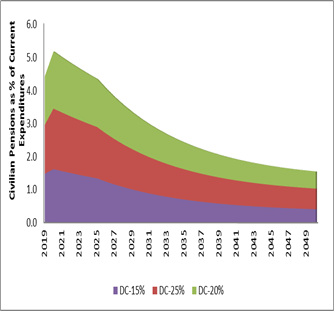

PIDE did projections for a DC system for federal government employees on financing side based on the following assumptions:

i. Existing Pensioners would get the same pensions as they are receiving now. We hold fixed the overall volume of pensioners, only exits from the system would allow inflation indexing for remaining. We project budget estimates of Civil Federal Pensions for 2019-20 remain constant for the next five years and then start to decline @ 5% per annum due to reduction in the number of pensioners.

ii. For those in government service assuming emoluments reckonable for pension to be current pay bill along with 30% of current allowances. We develop three scenarios of defined contribution funded by the government as 25%, 20% and 15% of the payroll.

iii. We assume current expenditures increase by 5% per annum

Figure X plots the final outlay of DC and ongoing existing pension expenditure as a percentage of current expenditures.

This basic exercise identifies that initially total pension outlays increase from 1.5% of the total current expenditures to around 1.83%, 1.72% and 1.61% for the three scenarios respectively in the 2020-21 that is the first year of reform. This initial rise tapers down to a starting level of 1.5% in the 6th, 5th and 3rd year respectively for the three scenarios and then continuously declines and converges around 0.50% in thirty years’ time period. If we make pension payouts sustainable in the long run we will have a flat pension’s curve!

[1] Business Recorder, August 28 2020, Accessed at https://www.brecorder.com/news/40015014/pm-says-pension-burden-becoming-unsustainable

Dear sir,

Aoa I read your article I am feeling shocked you do not change this but after in last paragraph I feel happy. I search past 4 to 5year about pension plan in my opinion is when the govt servant start service why not govt his contribution to use business purpose. I means whole employees starting same date all employees contribution to use 1 business unit/segments govt to accumulate profit to month wise. After 12month profit to save. After this when 20 to 25 year serve complete govt pay to employees contribution plus whole profit and if he continue service after 60 govt give advantage to these persons in business where govt in that person name started. In today like careem, Uber, service started govt to invest these services to earn because there huge investment required.

Yes, this is the best option. To collect/pool defined contributions from/for civil servants and invest them in reasonable businesses.