by Mahesh Sugathan and Gonzalo Varela

World leaders, key private sector players and civil society are meeting in Glasgow at the COP26 to reach a consensus on actions to keep global warming to 1.5 degrees Celsius above preindustrial levels and to secure net-zero emissions by 2050. Some of the actions considered affect directly the way in which firms will have to produce or trade their output. These actions aim at ensuring the environmental externality associated with production or trade is somehow internalized by firms, or simply reduced.[1] How can a country like Pakistan facilitate the ‘greening’ of its private sector, and how can trade ease that process?

Take the example of a garment exporter. She may be interested in recycling cotton to produce less water, energy, and dye-intensive clothing. She will need to invest in machinery to turn the cotton fabric into yarn, and then into fiber, which can then be reused to make new garments. If she wants to treat water waste, or transform the energy grid of her factory, she will need access to “environmental goods and services” (EGS): essentially, technologies or goods that help prevent or reduce environmental damage to water, air, soil, waste, noise, or eco-systems. A recent World Bank report discussed at a PIDE webinar suggests trade has an important role to play in ensuring access to EGS. But what is the ground reality in Pakistan? Do Pakistan’s trade policies ease or restrict the access to these EGS?

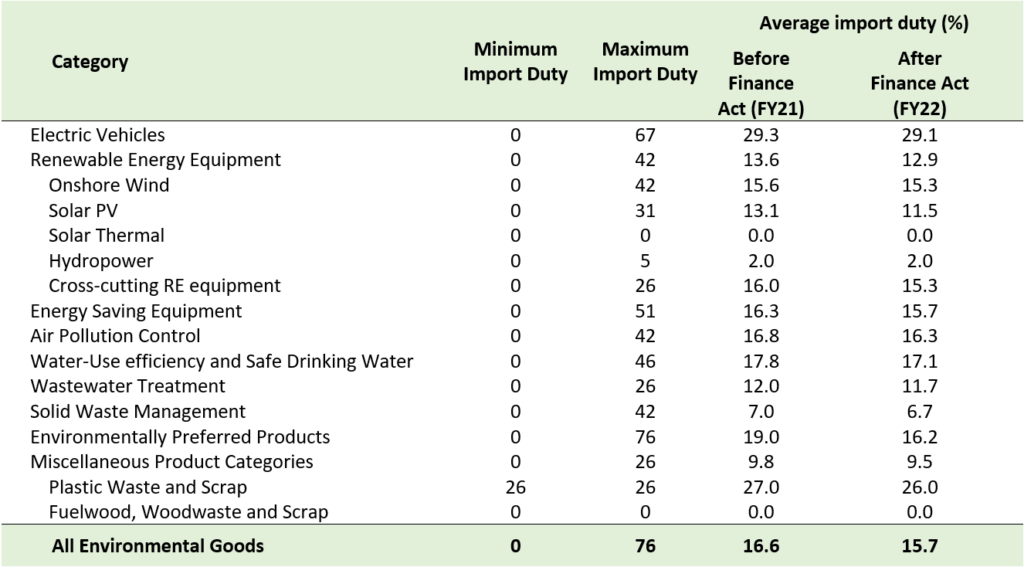

Import duties are the prime trade policy instrument in Pakistan that can encourage investments in EGS because they alter their price. The lower they are, the easier it will be for Pakistani firms to green production processes. As part of a collaboration between the World Bank and the Government of Pakistan, we looked at Pakistan’s import duties for a basket of EGs.[2] The review of Pakistan’s import duties of these tariff lines reveals a mixed picture (Table 1).

On average, import duties on environmental goods in Pakistan, at 15.7 percent, are lower than the average import duty across the entire tariff schedule (20 percent), also lower than the average duty on intermediate goods (also 20 percent), on capital goods (18.3 percent) or on vehicles (91.9 percent). Still, they are non-negligible, with substantial variations within broad categories. For example, many goods critical to clean energy supply, such as solar Photo-voltaic (PV) cells and modules, wind-powered generating sets, small and large-hydro turbines are already duty free as also goods related to efficient water-use such as drip irrigation and sprinkler systems. However, duties are much higher for a range of other goods such as many solar PV and wind-turbine components, light fittings fitted with LEDs, filtering, or purifying machines for gases (used in air-pollution control) and water-filtration and purifying machinery. The Finance Act of FY22 reduced import duties on EGS by slightly more than it reduced overall import duties. Again, the cuts were uneven and some sectors such as electric vehicles, waste-water treatment and sold waste management were barely impacted.

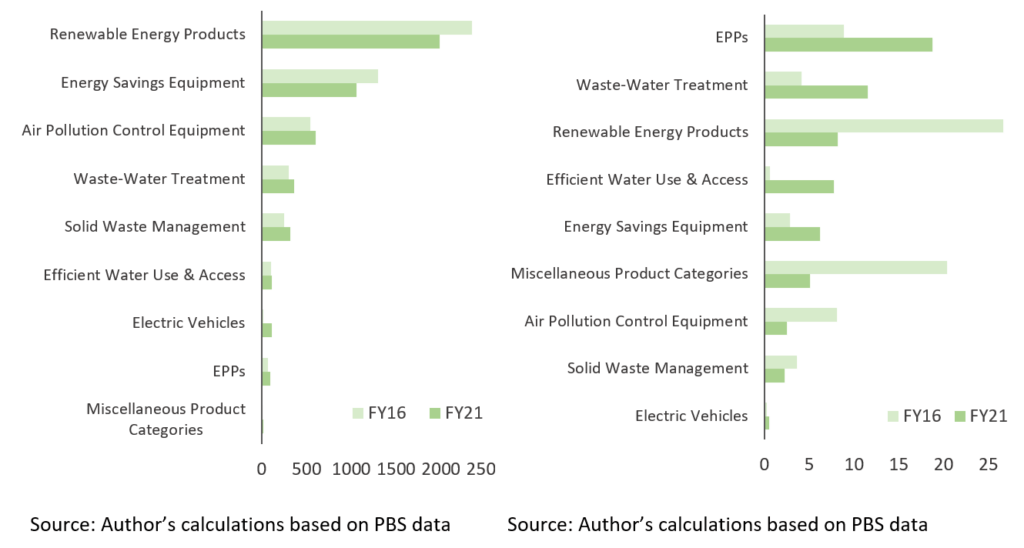

Frequently, high import duties are used to encourage domestic manufacturing. Yet, the analysis of Pakistan’s trade flows for EGS reveals that despite the high duties in many categories, Pakistan is a net importer in all identified categories (Figures 1 and 2), largely from China (perhaps owing to duty preferences that the China-Pakistan Free Trade Agreement provides), with negligible exports.

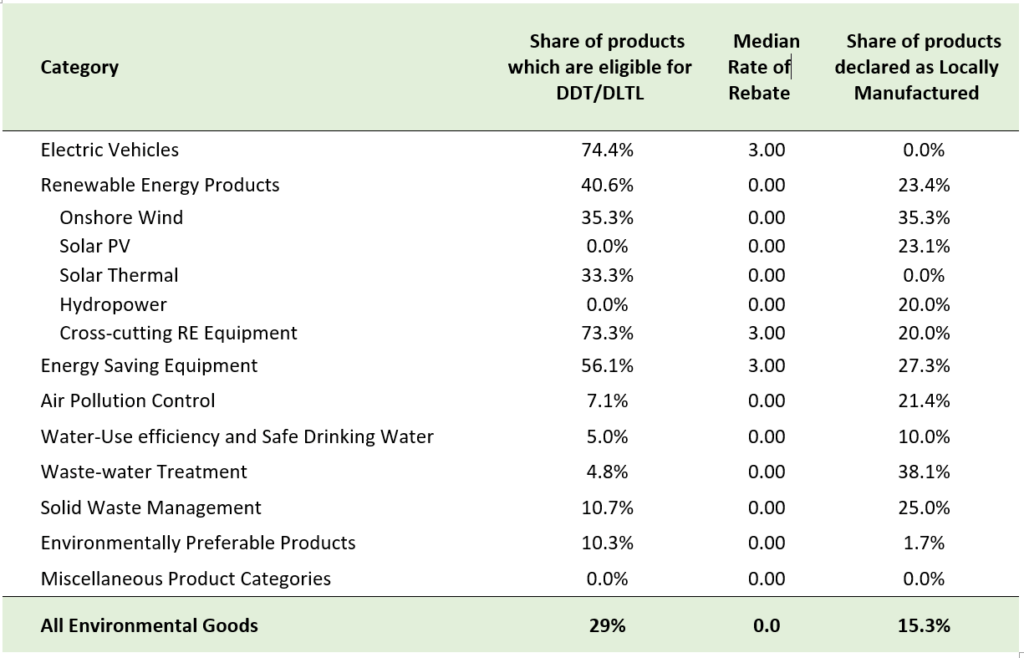

This is not only despite the import duties, but also other incentives provided, namely, the export rebates many of these products receive (in the form of Duty Drawback of Taxes (DDT) or Drawback of Local Taxes and Levies (DLTL)) and the ‘Locally Manufactured’ status granted by the Engineering Development Board and that secures them additional protection (Table 2).

Pakistan may need to re-think its policies to achieve two objectives in parallel. First, it needs to encourage Pakistani firms (as well as government entities and households) access to EGS at world prices to achieve environmental benefits, and make sure that firms that use EGS to ‘green’ their production process can show it to the world through efficient accreditation services. Secondly, it needs to promote competitive production and exports of some EGS themselves. The two objectives require different policy instruments.

The first objective requires gradually reducing import duties on EGS to zero and eliminating services trade restrictions on associated environmental services. This will help to secure market access in various export-oriented sectors of the economy moving forward if market access becomes conditional on greening of production processes. In practical terms, and through the China-Pakistan Free Trade Agreement (CPFTA), Pakistan already grants duty free imports for many of these goods. Reducing duties imposed on all other trading partners will increase the set of options firms face when choosing suppliers, without substantially reducing the import duty revenue collected by the government. It will also require strengthened systems and infrastructure to facilitate value chain traceability, including, for example, certification and inspection services to ensure products are genuinely environmentally preferable.

The second objective requires a smart approach for supporting manufacturers. To achieve it, Pakistan needs to leverage the opportunity that regional and global value chains provide. For example, given that China is the top exporter for a wide range of these environmental goods, and that the CPFTA is under implementation, Pakistan could actively promote FDI inflows in these segments. This will facilitate technology transfers and needed investments that could help strengthen Pakistan’s competitiveness in EGS sectors including for exports. Export rebates such as DLTL could also be used in a focused manner to give an additional boost to the production of EGS in which there’s a comparative advantage, as well as for products that benefit from incorporating green technologies in the production process.

Importantly, Pakistan should consider joining an Environmental Goods Agreement initiative to reduce trade-related tariffs and non-tariff barriers to environmental goods in case it is revived by World Trade Organization (WTO) members, as it could also send a positive signal for investors in the sector. It could also consider engaging actively in any WTO negotiations to reduce restrictions to trade in environmental services sectors as well.

The Carbon Border Adjustment Mechanism proposed by the EU is one example. ↑

The basket comprised 8-digit tariff lines largely selected from a broader universe of HS 6-digit subheadings put forward by WTO members during the Doha Round negotiations and compiled by the WTO Secretariat. These also cover 54 HS-6-digit sub-headings containing EGs that were agreed upon by APEC economies in 2012 for the purposes of a voluntary tariff reduction initiative. In addition, analytical reports and lists of EGs by organizations such as the World Bank United Nations Conference on Trade and Development (UNCTAD), the UN Environment Programme (UNEP), the Organization for Economic Co-operation and Development (OECD) and the International Centre for Trade and Sustainable Development (ICTSD) were also considered. ↑

About the authors:

- Mahesh Sugathan is Trade and Environment Specialist, World Bank

- Gonzalo J. Varela is Senior Economist, World Bank

It is essential to have robust policy and planning dimensions, to build your SME / Startup. More details at TANGENT https://www.tangent.com.pk/policy-and-planning

#financialadvisor #sme #pakistanstartups #pakistaneconomy #Pakistan #Islamabad #Lahore #Karachi #Peshawar #Quetta #Turkey #SriLanka