COVER PIECE (Discourse 2023-05)

Pakistan, a nation of over 220 million people, stands at a critical crossroads in its economic development journey due to the predicament of its energy sector. Despite possessing significant energy resources, Pakistan faces persistent challenges in ensuring a stable, reliable, and affordable energy supply – the governance of which involves, in a central capacity, independent power producers that were introduced into the domain with the 1994 Power Policy. This predicament has far-reaching consequences for the country’s economic growth, industrialisation, and overall well-being of its citizens. Import dependence on fuel is a critical aspect of Pakistan’s energy sector woes and is deeply intertwined with the political economy of the sector.

Pakistan’s energy mix is a complex amalgamation of various sources, with natural gas, oil, coal, hydropower, and renewables playing pivotal roles. Historically, the country has heavily relied on natural gas, which has led to the depletion of its reserves and an overreliance on imported energy sources like oil. International power producers in particular often use imported fuel sources, further contributing to the country’s import dependence. While they may provide much-needed energy capacity, their reliance on imported fuels can perpetuate the challenges associated with fuel importation. This heavy dependence on imported fuel sources has exposed Pakistan to global price fluctuations and supply disruptions, making its energy sector vulnerable and contributing to runaway inflation rates on a periodic basis.

International power producers, which have extracted guaranteed rates of return (15-18%) – regardless of changes in exchange rate and global prices of oil – from the government of Pakistan as part of the Power Policy of 1994 are a core facet of Pakistan’s energy sector predicament. This has led to the persistent ‘twin deficits’ crisis – in which both the fiscal account and balance of payments position have suffered tremendously. In order to keep up with payments, the government of Pakistan has had to persistently borrow from both domestic and international financial institutions: leading to what is commonly known as the ‘circular debt’ problem. When international fuel prices rise, the cost of electricity generation increases, leading to higher subsidies and unpaid bills within the energy supply chain. This, in turn, exacerbates the circular debt problem, hindering the financial health of power generation companies and their ability to invest in infrastructure and capacity expansion.

A fundamental reason for this is the adoption of a comprehensive move towards privatisation without adequate attention to detail in terms of internal governance arrangements of key institutions. Without an overarching vision and technically competent individuals occupying decision making roles within the sector, efforts towards reform have been haphazard and made even more difficult due to the opportunism of stakeholders that are primarily pursuing profits and revenue maximisation more generally. This is despite the fact that the National Electric Power Regulatory Authority (NEPRA) has been in place since 1997 – the overarching objective of which was to oversee the entirety of the power sector, regulate perverse behaviours of corporations, and ensure accessible, high quality power supply. Unfortunately, internal managerial dynamics and excessive politicking within the authority has prevented any possibility of moving towards efficiency in the sector.

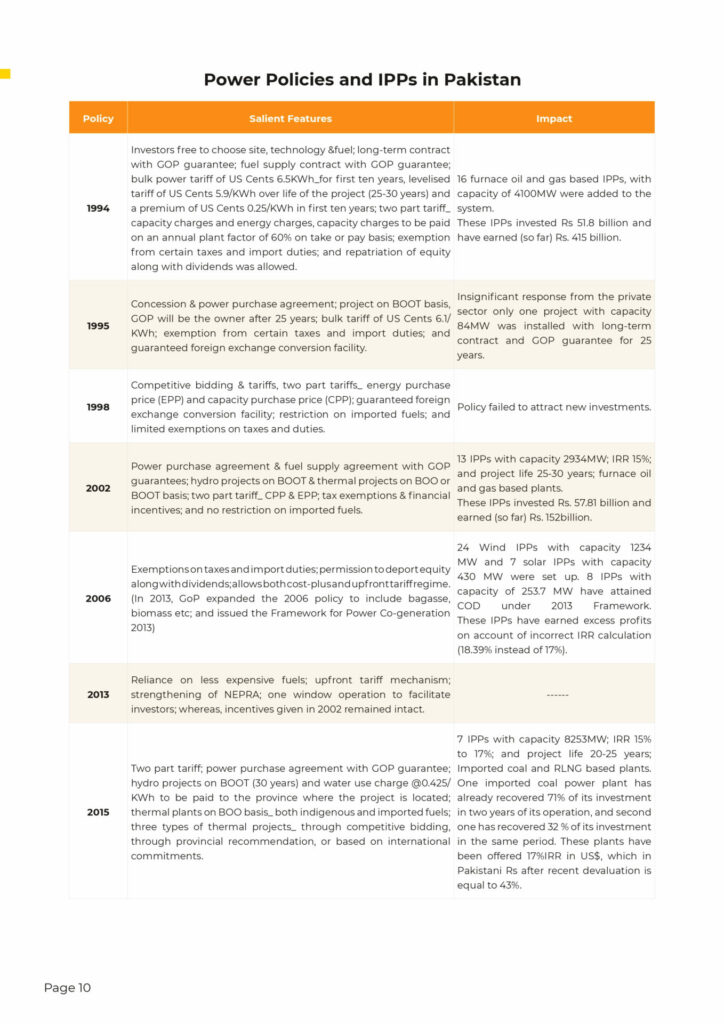

A summary of Pakistan’s power policies, with a focus on international power producers in particular is outlined in Table 1.

Table 1. Summary of Pakistan’s Power Sector Policies

One of the most pressing issues in Pakistan’s energy sector is the chronic shortage of electricity and gas, leading to frequent power outages known as load shedding. Import dependence on fuel significantly contributes to these shortages – and because subsequent governments have failed to diversify its sources of fuel imports, the country has remained at the mercy of a handful of countries with little to no bargaining power. This is an issue linked to the international political economy, with various projects – such as the Iran gas pipeline as well as the Turkmenistan-Afghanistan-Iran-Pakistan (TAPI) Corridor – being pushed to the backburner or discontinued entirely in order to maintain positive relations with the Western bloc, most importantly the United States. Fluctuations in international oil prices can have an immediate and direct impact on the cost of electricity generation in Pakistan, making it more expensive and financially unsustainable for power producers. The failure of the Ministry of Foreign Affairs to adopt dynamic, aggressive, and mutually beneficial policies that maximise Pakistan’s gains without alienating its strategic allies has been immensely detrimental to sustainable growth and development – with losses to GDP estimated at approximately 3-4% on an annual basis.

Import dependence on fossil fuels exacerbates environmental concerns in Pakistan. The heavy reliance on oil and coal for energy production contributes to air pollution, greenhouse gas emissions, and deforestation. These environmental issues have adverse effects on public health and add to the country’s vulnerability to climate change impacts. Transitioning towards cleaner and more sustainable energy sources is not only essential for environmental reasons but also for reducing import dependence on fuel. This is even more important considering Pakistan’s status as one of the most vulnerable countries in the world to the impacts of climate change – which disproportionately hurts the Global South in particular. Even here, subsequent governments have failed to strategise with regional neighbours to present a consolidated case for climate reparations: a central aspect of which could be lucrative energy deals and debt forgiveness.

Pakistan’s energy sector predicament, characterised by a major governance crisis, is a multifaceted challenge with far-reaching implications for the country’s economic and environmental sustainability. Addressing this challenge requires a nuanced approach that is fuelled by political will, including diversifying the energy mix, investing in renewable energy sources, improving energy efficiency, streamlining governance and ensuring policy stability.

International power producers can play a significant role in this transformation by adopting cleaner technologies and practices, reducing reliance on imported fuels, contributing to the development of a sustainable energy infrastructure, and renegotiating their terms of agreement with the government of Pakistan to wean off subsidies and move towards competition with one another in the domain. Considering recent runaway prices in fuel, which have led to both rising inflation rates as well as climbing levels of unemployment (i.e. stagflation), the latter point will have to be prioritised by all stakeholders involved in this space. The failure to do so could leave the government with no option other than nationalisation. Collaboration between the government and international investors is crucial to ensuring a stable, reliable, and affordable energy supply that supports Pakistan’s economic growth and environmental sustainability goals while reducing import dependence on fuel.

This issue of Discourse aims to chart out a path towards comprehensive energy sector reform, assessing the sector from a variety of perspectives – including rethinking governance, debt crises, transition to renewables, revitalising the gas sector, privatisation and its discontents, and much more. We hope this issue offers readers insight into the workings of one of the most important domains currently obstructing the growth and development of Pakistan’s economy.

References

Malik, A. (2021, May). In Power Projects: History, Policy and Politics – Pakistan Institute of Development Economics. PIDE. https://file.pide.org.pk/pdfpideresearch/par-vol2i5-03-in-power-projects-history-policy-and-politics.pdf