From Imports To Exports – An Achievement Of Mobile Phone Industry

Pakistan has performed in local hand set manufacturing and has gradually become exporter of mobile phones. Being a new product for exports, no specific export targets were set before but the “domestic increase in production of handsets” and “initiating export successfully” is encouraging. The local mobile phone manufacturing industry is expected to promote Pakistan’s in-house handset manufacturing, exports, the digital economy through providing mobile services particularly in the form of mobile broadband and hence; enhancing digital connectivity, ecosystem & innovation.

Introduction:

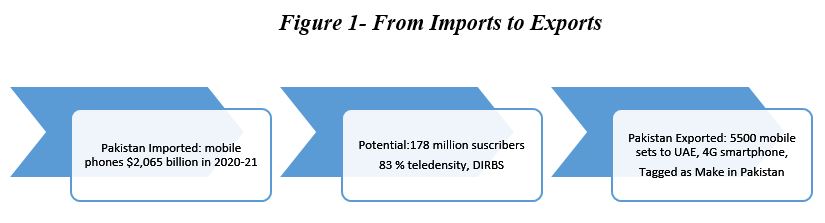

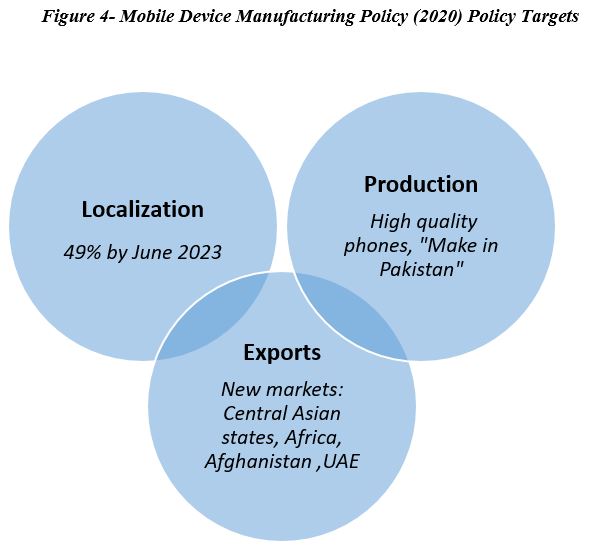

The mobile device manufacturing is one of the top five industries in the world that plays an important role in impelling economic growth. Pakistan has a huge market for mobile phones but majority of those handsets were being imported in Pakistan since 2020-21 (table 2). Almost 51% increase in imports of handsets was observed in FY 2020-21 (PBS). Side by side, Pakistan’s trade sector discovered some potential and tried its best to encourage Mobile phone industry to be able to become an exporter through certain quick reforms. To serve the purpose, Mobile Device Manufacturing Policy (2020) set three key targets: Localization, Production and Exports (See figure 4[1]). The right policy measures showed fruitful results and Pakistan became an exporter of handsets (see figure 1).

Initial data evidence shows an enormous accomplishment as the country was mainly an importer of mobile phones till 2021 and almost importing mobile phones of worth $2,065 billion in 2020-21(PBS). After realizing potential in market, the country decided to move towards exports of mobile phones and recently managed to export 5,500 units of 4G smart mobile sets to UAE (Haider, 2021)[2].

_________________________

[1] Mobile Device Manufacturing Policy (2020)

[2] (Haider, 2021), https://www.thenews.com.pk/

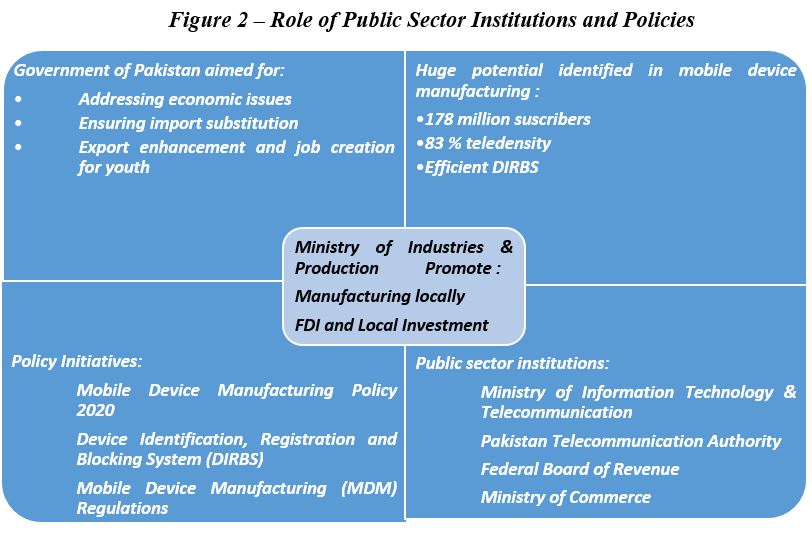

Government of Pakistan assessed potential in mobile phone manufacturing and decided to provide a policy framework that aims essentially to promote local manufacturing of PTA approved mobile devices in country. The “Mobile Device Manufacturing Policy 2020” addressed the central issues faced by mobile device manufacturers and to provide an attractive tariff environment over the policy period, besides other non-tariff[4] initiatives to promote “Make in Pakistan” strategy for mobile devices.

Import Data Facts:

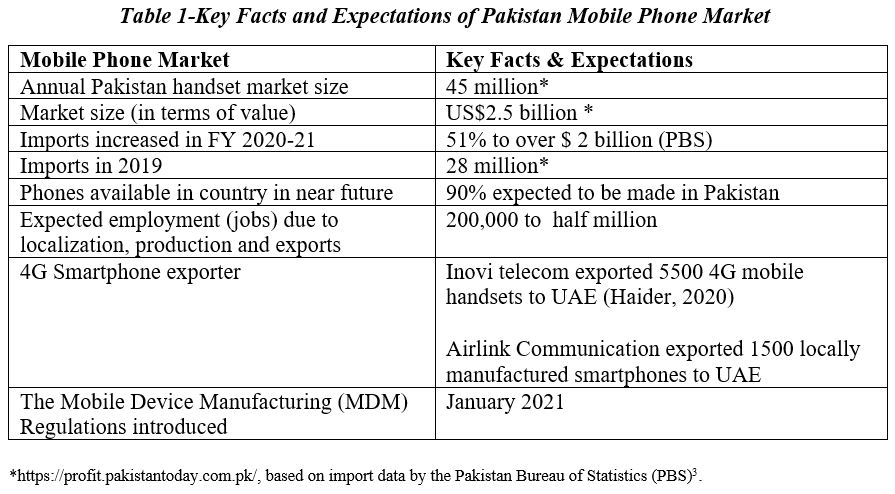

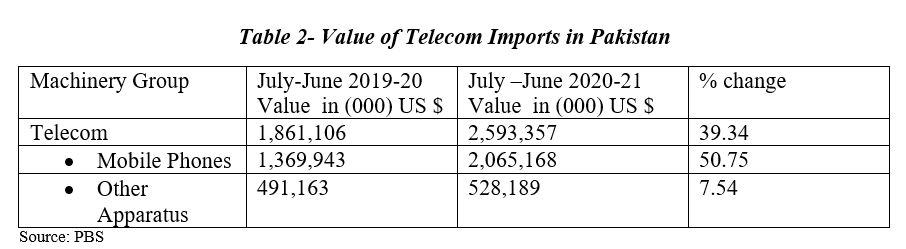

Pakistan imported mobile phones worth $2.065 billion during 2020-21 compared to $1.369 billion during 2019-20, showing growth of 50.75 percent. The overall telecom imports into the country during the period under review (July-June) 2020-21 increased by 39.33 percent by going up from $1.861 billion in 2019-20 to $2.593 billion during 2020-21. The manufacturers produced 12.27 million mobile phones while importers brought in almost 8.29m units during 2021[5].

_________________________

[3] Pakistan Bureau of Statistics

[4] An additional import restriction: State Bank Pakistan’s (SBP’s) import approval requirement that could be taken as a non -tariff barrier aiming at increasing import costs for a set of 25 products that had seen a sharp increase in imports between FY21 . Gonzalo (2022), Pakistan’s import ban

(https://profit.pakistantoday.com.pk/)

[5] https://www.dawn.com/news/1643056

Market Potential:

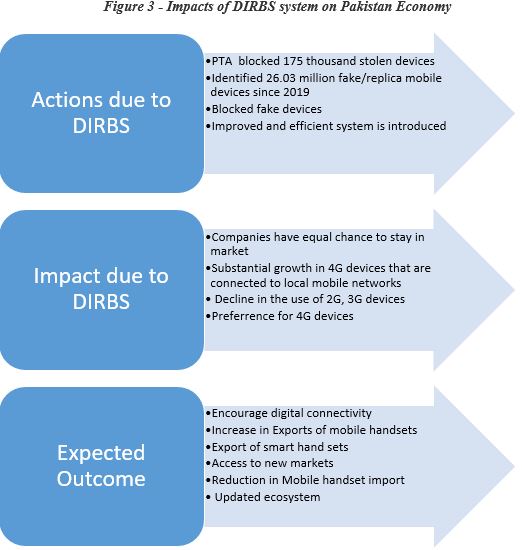

Pakistan has a benefit of low-cost labor availability, a fairly large home market having more than 178 million subscribers, which have increased approximately “1 percent” per month during last year alone, 83.3 percent tele-density and useful Device Identification, Registration and Blocking System (DIRBS)[6]. DIRBS has not directly resulted in export of mobile handsets but Pakistan provides an attractive arena/ market for in house mobile assembling. Initiating of DIRBS has become very advantageous in terms of encouraging legal imports and local manufacturing.

____________________________

[6] Launched by Pakistan Telecommunication Authority. https://www.pta.gov.pk/en

Source : PTA

Mobile Device Manufacturing Policy (2020) Policy targets:

- The Mobile Device Manufacturing Policy set a 49 percent localization target by June 2023, including 10 percent localization of parts of the motherboard and 10 percent localization of batteries. Currently Pakistan is concentrating on low-end mobile phone sets and soon expected to be able to start getting into high-end phones with world class companies .

- After achieving a milestone in manufacturing, Pakistan is trying exports to regional countries and Africa. one or two containers have already moved out of the country. Pakistan is looking forward to target markets in Afghanistan, the Central Asian Republics and Africa, UAE (figure 4) and then more diversification into the higher end market. The target is to penetrate low-end of export market and move up the value chain.

Policy Outcome and Achievements in Manufacturing Sector and Exports:

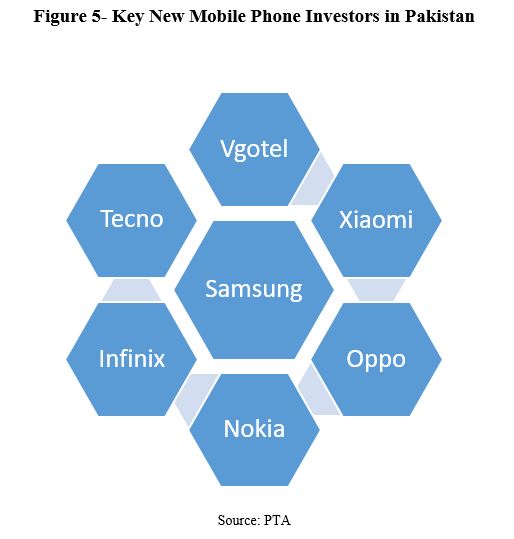

The role of public sector policy initiatives cannot be ignored in providing a boost to this sector. Factors for mobile phones rising demand may be manifold. Broadly it is due to the mobile phone policy incentives, reduction in taxes, recent changed work style and educational online trends, preference of new technology, ease in usage and time saving etc. The policy has targeted investment in the sector and investment policy outcome is clear with the evidence of key new mobile phone investors in the country (figure 5). Recently, after the first effective consignment of 4G smartphones to the UAE in 2022, the government has now fixed mobile phone export target at $1 billion for the current FY, connecting it with the incentives offered to local manufacturers.[7]

___________________________

[7] https://www.dawn.com/news/1643056

Recently several mobile set manufacturers have expressed willingness for investing in Pakistan. Samsung, one of these manufacturers that has partnered with Lucky Cement Limited to set up an assembly plant for locally manufacturing the smart mobile phones. According to PTA , almost 26 companies have been issued MDM authorization enabling them to manufacture mobile devices in Pakistan. The companies include renowned brands e.g. Samsung, Nokia, Oppo, TECNO, Infinix, Vgotel, Q-mobile and others.

Various Chinese mobile phone manufacturers are already investing in Pakistan and have played a key role in Pakistan’s mobile phone industry’s output boom in 2021. The Itel company has managed to manufacture 3.91 million mobile devices followed by VGO Tel at 2.97 million, Infinix 2.65 million Vivo 2.45 million, Techno 1.87 million, QQMEE 0.86 million and Oppo 0.67 million (Source: PTA). The situation is encouraging and will help the nation in achieving the goal of exporting and sustainable development as well as making Pakistan a global exporter of mobile devices.

Local production increased

- Big success of Mobile phone manufacturing in 2021

- Pakistan has become 4G exporter

- Exported the rst badge of 1500 locally manufactured smartphones to the United Arab Emirates (UAE)

Investment in market/Chinese players

- About 3.91 million mobile devices manufactured by Itel

- VGO Tel manfacturing was at 2.97 million, In nix 2.65 million Vivo 2.45 million, Techno 1.87 million, QQMEE 0.86 million and Oppo 0.67 million (Source:PTA)

Local manufacturing capacity increased

- Local manufacturing plants assembled 9.03 million smartphones while the number of 2G mobile phones was 13.09 million

- Pakistani phone manufacturers are now assembling major brands

Attracting investment

- “Make in Pakistan” policy attracted investors to contribute for the development of electronic eco-system

- New Firms entering in the market

- New rms will o er good quality, low-priced mobile handset devices

- The Mobile Device Manufacturing (MDM) Regulations of January 2021 encouraged manufacturers to establish their

units in Pakistan.

Employment for youth

- Employment opportunities for talented youth and to local technical and semi-technical manpower

- By increasing localization, production, and exports Pakistan will create further 200,000 to half million jobs

in the country

Conclusions

- Pakistan’s mobile phone industry showed an achievement.

- Handsets production increased with implementing new mobile phone manufacturing policy(2020) and efficient implementation of DIRBS.

- Due to investments/incentives, the country has managed to become an exporter of 4 G handsets.

- Correspondingly, being an exporter, there will be a boost in the digital economy through providing mobile services particularly in the form of mobile broadband and hence; enhancing export revenue, digital connectivity, ecosystem & innovation.

- The handset manufacturers are determined to meet the challenge of localization, production, and exports which will not only create jobs in the country but will improve export competitiveness.

Recommendations

- Introducing policies and efficient DIRBS has restored investors’ confidence to invest in Pakistan. A sustainability should be made to keep DIRBS running effectively.

- Pakistan must keep interacting with new investor/firms and offer policy incentives (whenever needed) to let them stay in the market.

- Pakistan needs to set production and export target for mobile phones in comming years.

- Domestic market of mobile phones needs to be established by some incentives, & ease of doing business. Any necessary policy change must be timely introduced to get full benefit out of it.

- For Mobile phone manufacturing, proper value chain needs to be developed.

Concluding Remarks:

Pakistan’s mobile phone manufacturing industry has shown its potential to increase domestic production of handsets, after implementation of new Mobile Devise Manufacturing Policy (2020) and Devise Identification Registration and Blocking System. Through new investments/incentives and DIRBS the country has managed to create favorable business environment and hence Pakistan become an exporter. This encouraging development will promote the exports of handsets in future. Correspondingly, being an exporter, there will be a boost in the digital economy through providing mobile services particularly in the form of mobile broadband and hence; enhancing export revenue, digital connectivity, ecosystem & innovation. The handset manufacturers are determined to meet the policy challenges of localization, production, and exports which will not only create jobs in the country but will improve export competitiveness. Introducing successful policies and efficient DIRBS has restored investors’ confidence to invest in Pakistan.

It is recommended that Pakistan must keep interacting with new mobile phone manufacturing investor/firms and offer policy incentives (whenever needed) to let them stay in the market. Domestic market of mobile phones needs to be established by provision of facilities incentives, investment & ease of doing business. Any necessary policy change must be timely introduced to get full benefit out of it. For handset manufacturing, proper value chain needs to be developed. A sustainability should be made to keep DIRBS running effectively.