Pakistan’s Power Sector Woes – Pt II

Editor’s Note: This is Part 2 of a 3 part article on Pakistan’s Power Sector: A Beginning with No End.

Introduction

In Part I of Pakistan’s power sector woes, we considered how our power sector performed at a regional level. We discussed how it fared in terms of pricing, market development, generation and transmission compared to other economies.

Let us now turn to the cost of service tariffs in Pakistan. Pakistan’s electricity prices are significantly higher in the region, and in some cases, highest in the world. For instance, the electricity tariff in Pakistan is around 30 – 40 percent higher than regional comparators. Considering the neighboring country of India, power tariffs vary widely across the country, where every state/province has an independent power system, from regulator to financial ownership and liability.

Distribution Licenses

In Pakistan, the issuance of distribution licensees under the existing regulatory regime means that each company has its defined service territory. Accordingly, the DISCO has a specific cost of service for supply of electricity to its service territory. The entire country is divided into regional markets and each distribution company is responsible to meet the supply requirement of its own market / service territory. The cost of service means differential tariffs for each market or service territory.

It is worth noting that NEPRA is determining tariff on the base of cost of service, and allocating cross-subsidies despite having no expertise in this area. The regulator lacks the resources of seasoned economists and technical experts to determine the efficacy of economic impact of subsidy/cross-subsidy – it is fundamentally wrong to ask a regulator to set these cross- subsidies for end-consumers as it is without doubt the government’s responsibility.

Supply Chain

The supply chain provides electricity to customers of the regional market(s) so all prudent costs are recovered through tariffs. There are a total of nine distribution companies in Pakistan, excluding K-Electric. They are allowed to incur an average of 16% line losses (which is recoverable from consumers through monthly bills). In addition to this, they book another 12% line losses, including due to theft. Moreover, their recoveries remain low by up to 20% against the monthly bills. A large number of consumers in far-flung areas are in the habit of not paying their bills. This is despite the fact that many of them are more than capable of doing so.

Such a tariff and accountability mechanism is of grave concern as there is no incentive for DISCOs to perform better. Moreover, under-performance is not penalized. A uniform national tariff policy means the entire system bears the brunt of a few low performing, inefficient DISCOs. The equality between high- and under- performers is wrong at every level, and the rather incentivization of under-performance is counterproductive.

The natural outcome of this self-imposed calamity is a power sector that is a severe drag on our economic potential. In FY2019, T&D losses accounted for approximately PKR 352 billion worth of electricity. Of that, PKR 300 billion is already part of the tariff. To allow such a significant portion of T&D losses to become part of consumer tariff is inexcusable. Breach of recovery targets by DISCOs (~10%) is causing further distress. In FY2019, we recorded losses from breaches amounting to PKR 172 billion (200% more than last year), creating bigger problems than T&D losses.

Tariff Design and Electricity Pricing

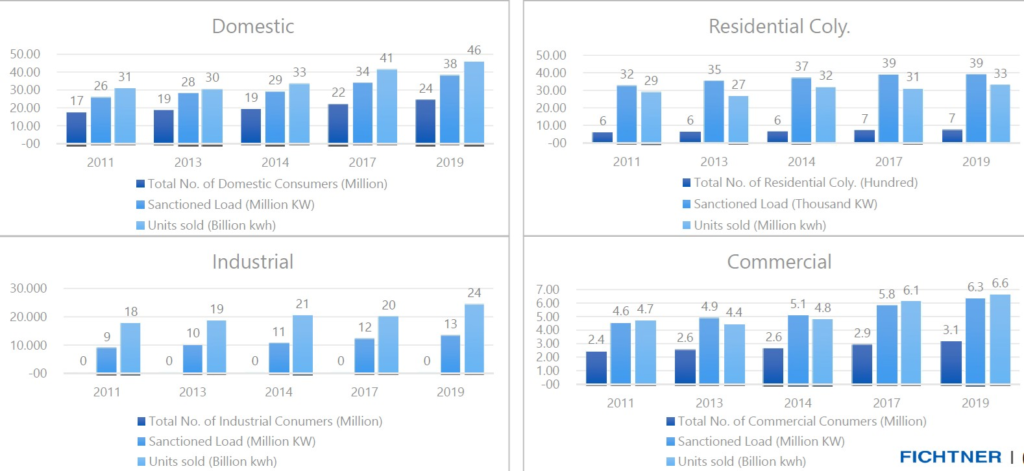

And what about tariff design and electricity pricing? How are various consumers and investors affected by it? Figure 3 shows energy consumption by consumer category in Pakistan. Now imagine that electricity tariffs for this eclectic mix are one of the highest in South Asia region. Pakistan’s cost of power production for the industrial sector is 26% higher as compared to other regional countries (like Vietnam, Sri Lanka, Malaysia, Bangladesh, South Korea, Thailand and India). It is also 28% costlier for residential areas than the regional countries.

To add to their woes, there is inconsistent regulation between NEPRA (responsible for regulation of the power sector) and OGRA (responsible for the regulation of oil and gas sectors). This sends confused signals to consumers and investors, and creates disharmony in pricing strategies between gas and electricity. Additionally, the tariff on gas and electricity is $6.5/MMBTU (PKR 10) and ₵9.0/kwh (PKR 15), creating opportunities for arbitrage in the system. Hence, the prices must be set in equilibrium at $6.5/MMBTU for gas and ₵7.5/kwh for electricity as one of the measures in establishing an efficient system design.

Charging a higher tariff rate for electricity than gas generated electricity is in fact taxing the SME’s as they don’t have self-generation capability and as a result, cannot compete. The importance of a level-playing field is evident in the fact that the SME sector employs 70-80% of labour. Growth of this sector results in the highest level of employment generation.

Source: FICHTNER Report Conducted on Behalf of APTMA

Incremental Block Tariffs

For residential customers, incremental block tariff (IBT) structure protects lifeline (or extremely small) users. Tariffs have increased across all slabs in nominal terms, and changed only for highest levels consumers in real terms. So the tariff structure has become more progressive, as higher levels of consumption have become more expensive. It is not the poor households (HHs) that are the biggest beneficiaries of electricity subsidy, but the richest 20 percent enjoy this privelege. The poorest HHs have become the main targets of IBT structure but receive roughly 10 percent of subsidies. This means that the electricity IBT remains a relatively inefficient method to protect poor HHs owing to ineffective lifeline tariffs, mismatch between tariff and poor HH consumption and such related factors.

Final Thoughts

The government’s idea of supporting consumers below the poverty line through cross- subsidization is a non-starter. This is because industry and businesses are asked to pay tariffs above costs to finance the cross-subsidy. This higher cost of electricity increases the cost of manufacturing, adversely impacting business competitiveness. Compelled to seek cheaper alternatives, industries switch to renewable energy sources (solar generation) resulting in a decline in state revenue. And where that doesn’t happen, poor implementation mechanisms result in the subsidy being enjoyed by the non-deserving still, while the poorest of the poor remain empty-handed.