Real Estate Myths in Pakistan and the Truth Behind Them

Our Future and the Real Estate Sector

General perception among people to make their future secure drives them to invest in the real estate sector in Pakistan. However, due to heavy taxes imposed on the real estate sector by the previous government, investment trends in real estate have shrunk, resulting in a complete obliteration of this sector. Pakistan’s real estate market has a large contribution in economic growth, posting growth even as foreign direct investment falls or infrastructure spending remains stingy. The real estate sector assets contribute from 60 – 70% of the country’s wealth – approximately, USD 300 to USD 400 billion as estimated by the World Bank.

It is the second largest employment-generation sector in Pakistan after agriculture. Apart from direct employment, it also stimulates the demand of more than 400 industries of the economy from construction (cement, steel, paint, building material, architects, urban planners) to financial services (house financing). As the government has increased amounts of various taxes, especially in terms of sale and purchase, and strict measure were introduced to prove the money-trail behind the investments within last three years. consequently, this sector has suffered by a severe economic crisis, many offices of real estate consultants are closed, and millions of people affiliated to this sector are now starving.

Over-Regulation of the Market

FBR’s strict regulations (ban on non-filers, compulsory registrations when buying property of more than PKR 5 million and levying high taxes on property transfer) has discouraged investors in this sector. Although, financial markets are experiencing volatility, it’s not the economic indicator you might think. But as an investment option, a myth prevails that real estate sector makes a lot of money is not true. In most countries where financial markets are not playing a key role in economic growth, the real estate sector steps in.

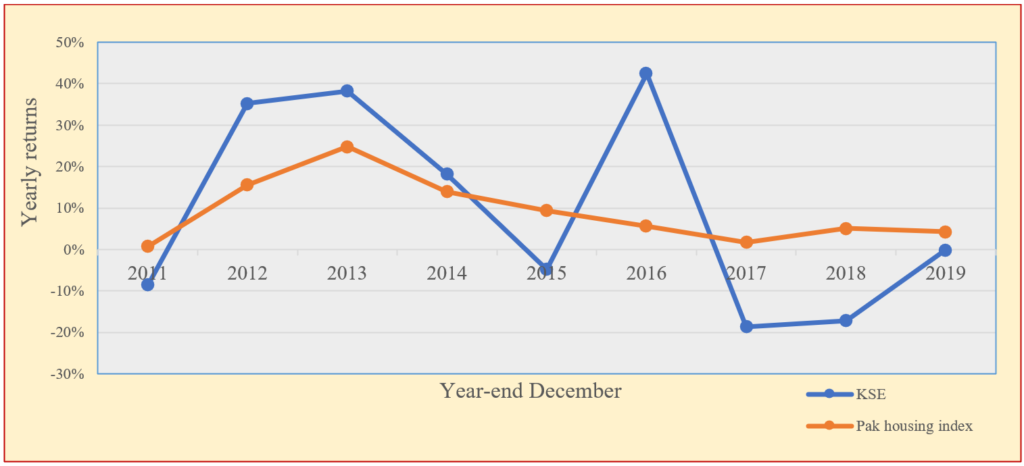

Unfortunately, this sector is not able to do so because of over-regulation by the government and the FBR. Consider the housing price index and KSE-100 index (Figure 1 below). Between 2011 and 2019, cumulative return of housing prices has been high compared to KSE-100 for only 3 years. In the same period, the KSE-100 index has increased by 230 percent versus 147 percent for housing prices.

Source: https://www.psx.com.pk, https://www.zameen.com

There are occasionally certain cycles in investments, and it has also occurred in real estate sector of Pakistan from 2012 to 2015, where yearly returns were 16 percent, 25 percent and 14 percent respectively. In all other years, return for housing index are in single digit from 1 percent to 9 percent. Whereas, the KSE-100 index is more volatile and offers high returns and high losses; the highest return earned by KSE-100 was 42 percent in 2016 and reported 19 percent loss in 2017.

The Post 2018 Real Estate Market

Real estate market has had a very difficult time after the change of regime in 2018. It has faced financial, economic, political challenges, a number of policy issues and lack of confidence. It barely managed to survive the earlier recession, mainly due to massive investments by overseas Pakistanis. Depreciation of the Pakistani rupee made property investment cheaper due to exchange rate benefits for overseas investors.

According to Zameen.com, over 30% of traffic on their site is from overseas Pakistanis looking for investment. But investing in the real estate market is already risky, as Pakistan currently ranks 120th out of 129 countries (scoring just 3.9/10). This type of ranking is an important consideration for overseas investors. In the presence of such uncertainty and tax policies, thousands of the overseas investors have diverted their investments elsewhere. These countries (e.g. UAE and UK) are offering better incentives so volume of foreign exchange for real estate investment has dropped.

SBP has reported that Pakistan received USD 21.84 billion remittance during 2019-20. Most of the overseas investments are in the real estate sector because they face restrictions in doing other businesses. Over-regulation of the real estate sector discourages the overseas investors and may cause in reduction of remittances in Pakistan. Further the policy of non-utilization of development budgets by the government cause the contraction of the activities of this sector.

The Future of Real Estate

Apart from all the decision taken by the authorities, there were high hopes that this sector will have high growth in 2020. But the issue is much bigger this time that can potentially cause a serious crisis in the real estate markets across all big cities specifically Islamabad, Rawalpindi, Lahore and Karachi.

Increasing the tax for a potentially growing sector contributing to the economic growth like real estate sector can be damaging. Government should broaden the tax net by incentivizing of the sector first. In the current situation, government should form a revised policy for real estate sector.

Points to Ponder

Government must bring a well-structured, transparent and centralized system for investors as compared to the current complicated procedures of documentations and doubtful legal support. After giving the industry status to that industry, government should establish an industry regulator, approve rules regarding land acquisition and ownership and all property consultants and projects should be registered.

[1] My thanks to Nadeem Ul Haque for suggesting this topic and guidance through the research.